How the Yahoo Acquisition Is Starting to Affect Verizon

On June 13, 2017, Verizon (VZ) sealed the acquisition of Yahoo, marking the end of a deal that was announced in July 2016.

July 26 2017, Updated 7:44 a.m. ET

A $500 million charge as a result of the Yahoo acquisition

On June 13, 2017, Verizon (VZ) sealed the acquisition of Yahoo, marking the end of a deal that was announced in July 2016. Yahoo will be part of Oath, Verizon’s media division that blends AOL and brands like HuffPost and TechCrunch.

Yahoo’s acquisition is starting to affect Verizon. During Verizon’s 2Q17 earnings conference call, it will be interesting to get updates on Yahoo’s integration and further thoughts on the strategic outlook for the company. Verizon’s management anticipates a $500 million charge in the form of pre-tax expenses in 2Q17. Verizon agreed to pay approximately $4.5 billion for Yahoo acquisition after negotiating a price cut. The initial deal valued Yahoo at more than $4.8 billion.

Yahoo acquisition triggers job cuts

Verizon is gearing up to reduce its workforce with a planned layoff of 2,100 employees immediately after closing the Yahoo acquisition, which would mostly affect the AOL and Yahoo businesses. The retrenchment should help Verizon whittle down expenses.

$1 billion in cost savings

Verizon anticipates some cost synergies after it completes its absorption of Yahoo. For instance, the company stated that the acquisition should help it save more than $1 billion in operating expenses through 2020.

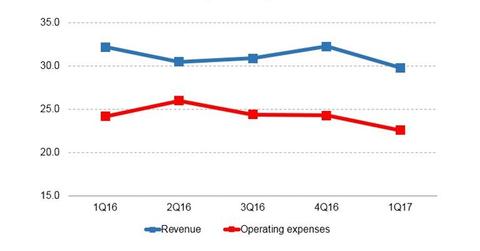

The above chart illustrates the trend line for Verizon’s operating expenses and revenues since 1Q16.