Packaging Corporation of America Declares Dividend of $0.63 Per Share

PKG fell 0.50% to close at $86.16 per share on December 14. The stock’s weekly, monthly, and YTD price movements were -1.3%, 0.22%, and 40.3%.

Dec. 16 2016, Updated 7:36 a.m. ET

Price movement

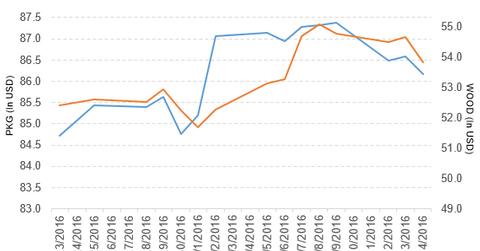

Packaging Corporation of America (PKG) has a market cap of $8.1 billion. It fell 0.50% to close at $86.16 per share on December 14, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -1.3%, 0.22%, and 40.3%, respectively, on the same day.

PKG is now trading 0.06% below its 20-day moving average, 3.3% above its 50-day moving average, and 19.8% above its 200-day moving average.

Related ETF and peers

The iShares Global Timber & Forestry ETF (WOOD) invests 4.9% of its holdings in PKG. The YTD price movement of WOOD was 12.7% on December 14.

The market caps of PKG’s competitors are as follows:

PKG declared a dividend

PKG has declared a regular quarterly dividend of $0.63 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders of record as of December 23, 2016.

PKG’s performance in 3Q16

PKG reported 3Q16 net sales of $1.48 billion, a YoY (year-over-year) rise of 0.90% over its net sales of $1.47 billion in 3Q15. Sales for the Packaging and Paper segments rose 2.0% and 0.31%, respectively, between 3Q15 and 3Q16. The company’s gross profit margin and operating margin fell ten basis points and 100 basis points, respectively.

Its net income and EPS (earnings per share) fell to $118.2 million and $1.26, respectively, in 3Q16, as compared to $126.3 million and $1.31 in 3Q15. It reported EBITDA (earnings before interest, tax, depreciation, and amortization) excluding special items of $298.9 million in 3Q16, a YoY fall of 0.03% from 3Q15.

Notably, PKG’s capital spending fell 12.8%, and its cash balance rose 49.7% between 3Q15 and 3Q16.

Next, we’ll look at Fortune Brands Home & Security (FBHS).