Nike Announces the Launch of New Products

Nike (NKE) fell 1.7% to close at $50.46 per share during the fifth week of November 2016.

Nov. 20 2020, Updated 12:45 p.m. ET

Price movement

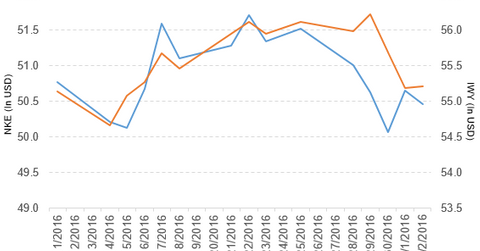

Nike (NKE) fell 1.7% to close at $50.46 per share during the fifth week of November 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.7%, 1.9%, and -18.3%, respectively, as of December 2, 2016.

NKE is trading 0.32% below its 20-day moving average, 1.9% below its 50-day moving average, and 9.6% below its 200-day moving average.

Related ETF and peers

The iShares Russell Top 200 Growth (IWY) invests 0.98% of its holdings in Nike. The YTD price movement of IWY was 3.1% on December 2, 2016.

The market caps of Nike’s competitors are as follows:

Latest news on Nike

In a December 1, 2016, press release, Nike stated, “For the first time ever, Nike (NYSE: NKE) is launching the best of the past, present, and future of basketball through the 12 Soles Collection, a series of silhouettes that celebrate Nike and Jordan Brand’s impact on the sport of basketball. Just in time for the holiday season, the coveted set of footwear featuring performance and reimagined icons will launch across the entire month of December, culminating with a Christmas day surprise launch. The first shoe drops this Saturday and will be available on the Nike+ SNKRS app, on nike.com, and at select retailers globally.”

Performance of Nike in fiscal 1Q17

Nike (NKE) reported fiscal 1Q17 revenue of $9.1 billion, a rise of 8.3% from $8.4 billion reported in fiscal 1Q16. Revenue from its Footwear, Apparel, and Equipment segments rose 6.8%, 8.9%, and 3.7%, respectively. Revenues from its Global Brand segment fell 42.3% between fiscal 1Q16 and fiscal 1Q17.

Nike’s revenue from North America, Western Europe, Central and Eastern Europe, Greater China, and Japan rose 6.1%, 7.4%, 9.7%, 15.1%, and 36.9%, respectively, in fiscal 1Q17. Its revenue from emerging markets fell 2.2% YoY (year-over-year) in fiscal 1Q17.

Nike’s net income and EPS (earnings per share) rose to $1.3 billion and $0.73, respectively, in fiscal 1Q17 compared to $1.2 billion and $0.67, respectively, in fiscal 1Q16.

Cash and cash equivalents

Nike’s cash and cash equivalents fell 18.1%, and its inventories rose 10.9% YoY in fiscal 1Q17. Its current ratio fell to 2.7x, and its debt-to-equity ratio rose to 0.74x in fiscal 1Q17, compared to 2.8x and 0.61x, respectively, in fiscal 1Q16.

Declared dividend

Nike has declared a quarterly cash dividend of $0.18 per share on its Class A and Class B common stock. The dividend will be paid on January 3, 2017, to shareholders of record at the close of business on December 5, 2016.

For an ongoing analysis of this sector, please visit Market Realist’s Consumer Discretionary page.