January 2017 EIA Estimates: US Shale Gas Production Could Fall

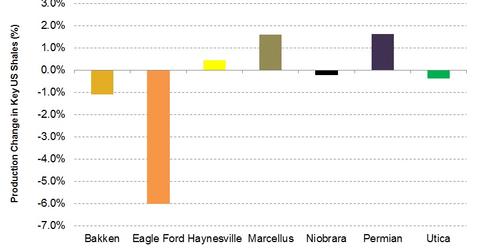

The EIA expects less natural gas production at four key US shales by January 2017 compared to November 2016. It expects production to rise at three key US shales.

Dec. 4 2020, Updated 10:53 a.m. ET

Key US shale natural gas production

Aggregate natural gas production at key shales already fell in November 2016 compared to October 2016. By January 2017, aggregate natural gas production at the seven key shales is expected to rise a marginal 0.10% compared to November 2016. The EIA estimates that natural gas production will fall 0.10% in December 2016 compared to November 2016.

January 2017 estimates: Marcellus to rise, Eagle Ford Shale to fall sharply

The Utica Shale, which accounted for ~9.0% of the US shale aggregate natural gas production in November 2016, is expected to see marginally lower natural gas production in January 2017.

At the Marcellus Shale, the largest natural gas–producing shale in the United States, production is expected to rise ~1.6% from November 2016 to January 2017.

The Eagle Ford Shale is the fourth-largest natural gas–producing shale among the seven key shales. It could see a ~6.0% fall in production by January 2017, the most significant fall in natural gas production among the shales.

How this will affect oilfield services companies

Lower natural gas production will negatively affect revenues and income for oilfield equipment and services companies such as Schlumberger (SLB), National Oilwell Varco (NOV), Halliburton (HAL), and Baker Hughes (BHI). National Oilwell Varco accounts for 0.08% of the SPDR S&P 500 ETF (SPY).

You can find out more about the oilfield equipment and services industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer.