How Has BorgWarner Been Doing?

Price movement BorgWarner (BWA) has a market cap of $9.1 billion. It rose 0.07% to close at $41.63 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 13.0%, 18.2%, and -2.2%, respectively, on the same day. BWA is trading 16.3% above its 20-day moving average, 18.0% above […]

Nov. 20 2020, Updated 10:58 a.m. ET

Price movement

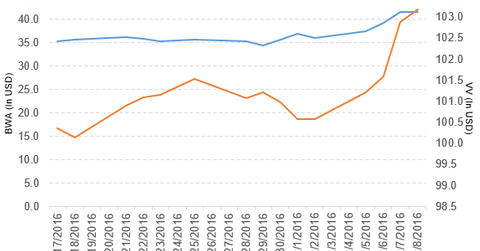

BorgWarner (BWA) has a market cap of $9.1 billion. It rose 0.07% to close at $41.63 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 13.0%, 18.2%, and -2.2%, respectively, on the same day. BWA is trading 16.3% above its 20-day moving average, 18.0% above its 50-day moving average, and 21.5% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.03% of its holdings in BorgWarner. The YTD price movement of VV was 12.0% on December 8. The market caps of BorgWarner’s competitors are as follows:

About BorgWarner

In a press release on December 8, 2016, BorgWarner described itself as supplying “advanced wastegate turbocharging technology for numerous hybrid electric vehicles (HEVs) from BYD Auto Industry Company Limited. The proven, highly durable turbochargers boost BYD Auto’s 1.5-liter direct injection gasoline engine in its Qin, Song and Yuan HEVs as well as the 2.0-liter direct injection gasoline engine in its Tang and Song HEVs. As efficiency enablers for hybrid powertrains, BorgWarner’s wastegate turbochargers are designed to meet challenging emissions requirements by offering powerful yet efficient performance.”

It added that “the locally produced turbocharging solutions provide excellent torque characteristics over the entire engine speed range while improving fuel economy for hybrid powertrains. In addition, BorgWarner also delivers its technology for numerous gasoline powered vehicles of BYD Auto.”

Performance of BorgWarner in 3Q16

BorgWarner (BWA) reported 3Q16 net sales of $2.2 billion, a rise of 15.8% over its net sales of $1.9 billion in 3Q15. The company’s gross profit margin expanded 20 basis points, and its operating margin narrowed 580 basis points.

Its net income and EPS (earnings per share) fell to $83.3 million and $0.39, respectively, in 3Q16, compared with $157.4 million and $0.70, respectively, in 3Q15.

The company reported non-GAAP (generally accepted accounting principles) EPS of $0.78 in 3Q16, a rise of 6.8% over 3Q15. BWA’s cash and inventories fell 10.2% and 5.0%, respectively, between 4Q15 and 3Q16.

Projections

BorgWarner (BWA) made the following projections for 4Q16:

- net sales growth of 14.3%–17.8%

- EPS of $0.82–$0.86, including ~$0.02 per share from its Remy acquisition

The company has made the following projections for 2016:

- net sales growth of 15.2%–16.0%

- EPS of $3.24–$3.28, including ~$0.12 per share from its Remy acquisition

For an ongoing analysis of this sector, please visit Market Realist’s Consumer Discretionary page.