Drew Industries Announces Change of Name and Ticker Symbol

Drew Industries (DW) rose 3.4% to close at $111.80 per share during the third week of December 2016.

Dec. 29 2016, Updated 7:37 a.m. ET

Price movement

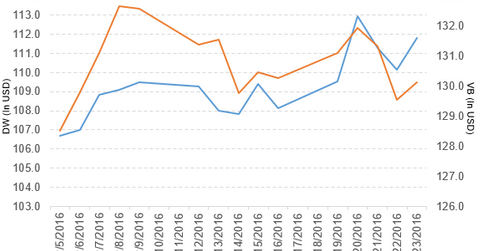

Drew Industries (DW) rose 3.4% to close at $111.80 per share during the third week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.4%, 9.0%, and 86.7%, respectively, as of December 23.

DW is trading 3.8% above its 20-day moving average, 13.5% above its 50-day moving average, and 30.2% above its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.07% of its holdings in Drew Industries. The YTD price movement of VB was 18.8% on December 23.

The market caps of DW’s competitors are as follows:

- Thor Industries (THO): $5.3 billion

- Berkshire Hathaway (BRK.A): $409.2 billion

Latest news on DW

On December 19, 2016, Drew Industries reported that “its Board of Directors has approved changing the Company’s corporate name to ‘LCI Industries.’ Through its wholly-owned subsidiary Lippert Components, Inc. ([or] LCI) and its subsidiaries, Drew Industries supplies a broad array of components for the leading OEMs [original equipment manufacturers] of recreational vehicles ([or] RVs) and adjacent industries, as well as the aftermarkets of these industries.”

The news release went on to say, “Lippert Components’ business has grown considerably over the past decade, and the new corporate name was selected to better align the investment community with the strength of the LCI brand in the industries it serves.”

It added, “The effective date of the name change will be December 30, 2016. The Company has reserved the ticker symbol ‘LCII’, and the Company’s common stock will begin trading on the New York Stock Exchange under its new name and trading symbol effective as of the market open on January 3, 2017.”

3Q16 performance

Drew Industries reported 3Q16 net sales of $412.4 million, a YoY (year-over-year) rise of 19.4% compared to $345.3 million in 3Q15. The company’s gross profit margin and operating margin expanded 410 basis points and 300 basis points, respectively, YoY in 3Q16.

Its net income and EPS (earnings per share) rose to $29.8 million and $1.19, respectively, in 3Q16 compared to $17.3 million and $0.70, respectively, in 3Q15.

DW’s inventories fell 9.8% YoY in 3Q16. It reported cash and cash equivalents of $95.1 million in 3Q16 compared to $7.3 million in 3Q15. Its current ratio rose to 2.4x, and its debt-to-equity ratio fell to 0.46x in 3Q16 compared to 2.2x and 0.60x, respectively, in 3Q15.

In the next part, we’ll look at Skechers USA (SKX).