Conagra Brands Declares a Dividend and a New Board Appointment

Conagra Brands (CAG) rose 4.2% to close at $38.44 per share during the first week of December 2016.

Dec. 12 2016, Updated 6:05 p.m. ET

Price movement

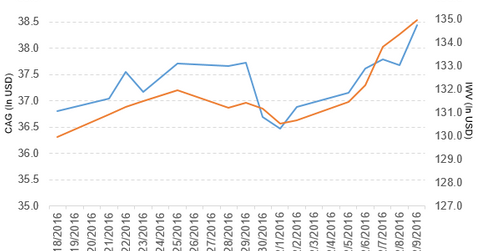

Conagra Brands (CAG) rose 4.2% to close at $38.44 per share during the first week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.2%, 3.3%, and 19.8%, respectively, on December 9, 2016.

CAG is trading 4.6% above its 20-day moving average, 4.4% above its 50-day moving average, and 8.3% above its 200-day moving average.

Related ETF and peers

The iShares Russell 3000 ETF (IWV) invests 0.09% of its holdings in Conagra Brands. The YTD price movement of IWV was 13.7% on December 9.

The market caps of Conagra Brands’ competitors are as follows:

Latest news on Conagra Brands

Thomas W. Dickson has been appointed to Conagra Brands’ board of directors, effective immediately.

Quarterly dividend

Conagra Brands has declared a quarterly dividend of $0.20 per share on its common stock. The dividend will be paid on March 1, 2017, to shareholders of record at the close of business on January 30, 2017.

Performance of ConAgra Foods in fiscal 1Q17

ConAgra Foods reported fiscal 1Q17 net sales of $2.7 billion, a fall of 4.3% from its net sales of $2.8 billion in fiscal 1Q16. Sales of the Grocery & Snacks, Refrigerated & Frozen, International, Foodservice, and Commercial segments fell 5.4%, 8.1%, 5.7%, 1.0%, and 2.0%, respectively, between fiscal 1Q16 and fiscal 1Q17.

CAG’s net income and EPS (earnings per share) rose to $186.2 million and $0.42, respectively, in fiscal 1Q17, compared to -$1.2 billion and -$2.65, respectively, in fiscal 1Q16. It reported EPS from continuing operations of $0.61 in fiscal 1Q17, a rise of 48.8% compared to fiscal 1Q16.

CAG’s cash and cash equivalents fell 4.8%, and its inventories rose 3.5% between fiscal 4Q16 and fiscal 1Q17. Its current ratio rose to 1.44x, and its debt-to-equity ratio fell to 2.4x in fiscal 1Q17, compared to 1.41x and 2.5x, respectively, in fiscal 4Q16.

This earnings report is the final one from ConAgra Foods due to the spin-off that will result in ConAgra Brands and Lamb Weston. Next, let’s look at Avery Dennison (AVY).