Comparing General Motors and Ford’s Huge Pension Obligations

In the last six years, Ford contributed ~$12.9 billion to its pension funds. It’s the main reason why it has a better-funded status than General Motors.

Dec. 9 2016, Updated 12:35 p.m. ET

General Motors and Ford

Previously in this series, we looked at two types of pension plans—the defined benefit plan and defined contribution plan. In recent years, automakers (IYK) including General Motors (GM) and Ford (F) have been shifting employees from defined benefit plans to defined contribution plans. Now, let’s discuss how General Motors and Ford’s current pension obligations look. We’ll also analyze their funding status.

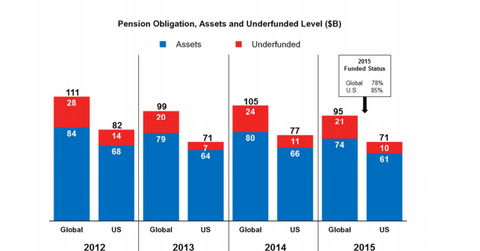

Comparing the pension obligations

At the end of fiscal 2015, General Motors’ global pension obligations stood at $95 billion. They were underfunded by $21 billion. General Motors’ funding status was at 78%. At the same time, Ford’s global pension obligations stood at $75 billion. They were underfunded by $8 billion. Ford’s funding status was at 89%—much better than General Motors’ funding status.

In the last six years, Ford contributed about $12.9 billion to its pension funds. It’s the main reason why the company has a better-funded status than General Motors.

As of December 31, 2015, General Motors’ pension obligations were higher than General Electric (GE) but lower than IBM’s (IBM) pension obligations.

Who’s doing better?

While Ford improved its funded status by contributing a huge sum to its pension funds in the last few years, General Motors has also been trying to reduce its huge pension liabilities.

In 2012, General Motors decided to pay a lump-sum amount to 42,000 of its retired employees instead of continuing with their monthly pension payments. The same year, General Motors also hired a third-party firm to manage the pension obligations of another 76,000 retirees. These moves helped the company reduce its pension obligations by $26 billion. However, its underfunded status didn’t improve much.

In the last few years, Ford reduced some of its pension liabilities by offering a lump-sum amount to its retirees. Overall, Ford’s better-funded status percentage than General Motors could be an advantage for the company’s future growth.

Next, we’ll look at how changes in discount rates can impact automakers’ pension liabilities.