Berry Plastics Appoints New President for Consumer Packaging Division

Berry Plastics reported fiscal 4Q16 net sales of $1.6 billion, a rise of 35.3% compared to net sales of $1.2 billion in fiscal 4Q15.

Dec. 30 2016, Updated 7:38 a.m. ET

Price movement

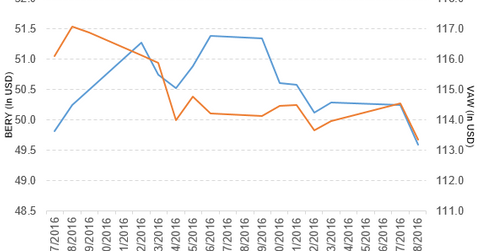

Berry Plastics Group (BERY) has a market cap of $6.0 billion. It fell 1.3% to close at $49.59 per share on December 28, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.0%, 8.0%, and 37.1%, respectively, on the same day.

BERY is trading 1.2% below its 20-day moving average, 5.4% above its 50-day moving average, and 19.1% above its 200-day moving average.

Related ETF and peers

The Vanguard Materials ETF (VAW) invests 0.65% of its holdings in Berry Plastics. The YTD price movement of VAW was 22.5% on December 28.

The market caps of Berry Plastics’s competitors are as follows:

Latest news on BERY

Effective January 1, 2017, Jean-Marc Galvez will serve as president of Berry Plastics Group’s Consumer Packaging division. Currently, Galvez serves as president of the company’s Health, Hygiene, and Specialties division for Europe, Middle East, India, and Africa.

Performance of Berry Plastics in fiscal 4Q16

Berry Plastics reported fiscal 4Q16 net sales of $1.6 billion, a rise of 35.3% compared to net sales of $1.2 billion in fiscal 4Q15. The company’s operating margin expanded 40 basis points in fiscal 4Q16 compared to fiscal 4Q15.

Its net income and EPS (earnings per share) rose to $77.0 million and $0.61, respectively, in fiscal 4Q16 compared to $48.0 million and $0.39, respectively, in fiscal 4Q15. It reported adjusted EPS of $0.73 in fiscal 4Q16, a rise of 46.0% compared to fiscal 4Q15.

Fiscal 2016 results

In fiscal 2016, BERY reported net sales of $6.5 billion, a rise of 32.9% YoY (year-over-year). Its net income and EPS rose to $236.0 million and $1.89, respectively, in fiscal 2016 compared to $86.0 million and $0.70, respectively, in fiscal 2015.

Berry Plastics’s cash and cash equivalents and inventories rose 41.7% and 26.4%, respectively, in fiscal 2016. It reported adjusted free cash flow of $517.0 million in fiscal 2016, a rise of 18.6% YoY.

Projections

BERY has made the following projections for fiscal 2017:

- adjusted free cash flow of $550 million

- capital spending of $315 million

- cash interest costs of $275 million

Next, we’ll look at Sony (SNE).