Why Has Mondelēz International Been Rising for Two Months?

Mondelēz International’s (MDLZ) stock rose 3.6% to $44.32 per share on October 26, 2016, after the announcement of the company’s 3Q16 results.

Nov. 25 2016, Published 2:05 p.m. ET

Notable price movements

Mondelēz International’s (MDLZ) stock rose 3.6% to $44.32 per share on October 26, 2016, after the announcement of the company’s 3Q16 results. The company exceeded the consensus analysts’ earnings estimates by 20.9% but failed to surpass sales estimates by 1.0% for the quarter.

On November 8, 2016, the company’s stock price rose 4.1% after speculation that Kraft Heinz (KHC) will acquire Mondelēz to expand its portfolio of brands. This speculation came after 3G Capital announced that it would raise funds to finance the acquisition of a consumer products company.

Price movement

The stock’s weekly, monthly, and YTD (year-to-date) price movements were 2.4%, 1.9%, and –0.9%, respectively, as of November 22. Mondelēz International is trading 0.0% below its 20-day moving average, 0.97% above its 50-day moving average, and 1.6% above its 200-day moving average. Mondelēz International has a market cap of $67.1 billion.

Year-to-date performance

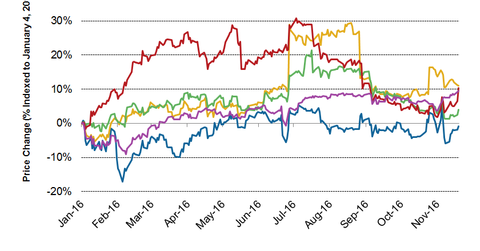

Mondelēz International has underperformed its peers and the S&P 500 Index on a YTD basis. The stocks of Hershey (HSY), Kellogg (K), and Campbell Soup (CPB) have returned 11.1%, 4.0%, and 10.4%, respectively, on a YTD basis.

As of November 22, the S&P 500 Index return and the PowerShares Dynamic Food & Beverage Portfolio (PBJ) have grown 9.5% and 4.2%, respectively, as of November 22. Mondelēz constitutes 5.3% of the holdings of PBJ.

Series overview

In this series, we’ll discuss the revenue and sales growth expectations for Mondelēz International in 4Q16. We’ll also discuss the company’s valuation and analysts’ recommendations.

Continue to the next part for a look at the company’s revenue.