Why Did Kellogg Rise on November 8?

Price movement Kellogg (K) has a market cap of $27.4 billion. It rose 2.7% to close at $76.96 per share on November 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.3%, 0.64%, and 8.6%, respectively, on the same day. Kellogg is trading 2.8% above its 20-day moving average, 0.17% below […]

Nov. 10 2016, Updated 10:04 a.m. ET

Price movement

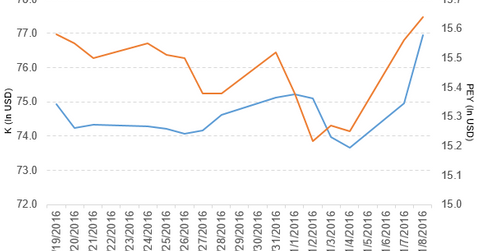

Kellogg (K) has a market cap of $27.4 billion. It rose 2.7% to close at $76.96 per share on November 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.3%, 0.64%, and 8.6%, respectively, on the same day. Kellogg is trading 2.8% above its 20-day moving average, 0.17% below its 50-day moving average, and 0.25% above its 200-day moving average.

Related ETF and peers

The PowerShares High Yield Equity Dividend Achievers Portfolio ETF (PEY) invests 1.5% of its holdings in Kellogg. The ETF aims to tracks a yield-weighted index of US companies that have increased their annual dividends for at least ten consecutive years. The YTD price movement of PEY was 20.6% on November 8.

The market caps of Kellogg’s competitors are as follows:

Latest news on Kellogg

Kellogg rose 2.7% on November 8, 2016, after speculation that Kraft Heinz may acquire Kellogg to strengthen its presence in the market. In a press release, Reuters reported that “3G Capital Inc, the buyout firm controlled by Brazilian billionaire financier Jorge Paulo Lemann, is raising between $8 billion and $10 billion to finance an acquisition of a global consumer goods firm, a Brazil-based blog said on Tuesday.”

Performance of Kellogg in fiscal 3Q16

Kellogg reported fiscal 3Q16 net sales of $3.25 billion, a fall of 2.4% from the net sales of $3.33 billion in fiscal 3Q15, due to unfavorable currency headwinds. The company’s operating margin expanded by 260 basis points between fiscal 3Q15 and fiscal 3Q16 due to a reduction in selling, general, and administrative expenses.

Its net income and EPS (earnings per share) rose to $292.0 million and $0.82, respectively, in fiscal 3Q16, compared with $205.0 million and $0.58, respectively, in fiscal 3Q15. A reduction in one-time costs, the effective tax rate, and wider margins impacted EPS. The company reported EPS of $0.96 in fiscal 3Q16, a rise of 12.9% over fiscal 3Q15.

Kellogg’s cash and cash equivalents rose 37.8%, and its inventories fell 2.4% between fiscal 4Q15 and fiscal 3Q16. Its current ratio and long-term debt-to-equity ratio rose to 0.66x and 2.9x, respectively, in fiscal 3Q16, compared with 0.56x and 2.5x in fiscal 4Q15.

Quarterly dividend

Kellogg has declared a regular dividend of $0.52 per share on its common stock. The dividend will be paid on December 15, 2016, to shareholders of record at the close of business on December 1, 2016.

Projections

Kellogg has made the following projections for fiscal 2016:

- currency-neutral comparable EPS of $4.16 to $4.23

- currency-neutral comparable operating profit growth of 15.0% to 17.0%

- currency-neutral comparable net sales growth below 4%

- cash flow of ~$1.1 billion

In the next part, we’ll look at Johnson Controls (JCI).