Why Did Ctrip Invest in Skyscanner?

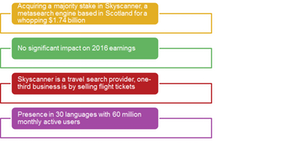

In its earnings call on November 23, Ctrip.com (CTRP) announced that it acquired a majority stake in Skyscanner, a metasearch engine based in Scotland, for ~$1.7 billion.

Nov. 30 2016, Updated 10:05 a.m. ET

Skyscanner investment

In its earnings call on November 23, Ctrip.com (CTRP) announced that it acquired a majority stake in Skyscanner, a metasearch engine based in Scotland, for ~$1.7 billion. The deal is expected to close before the end of 2016 and should not have a significant impact on its 2016 earnings.

Ctrip.com plans to buy out the major investors in Skyscanner, which include Yahoo! Japan, Sequoia Capital, and Malaysian sovereign wealth fund Khazanah Nasional.

Skyscanner overview

Skyscanner is a travel search provider, and one-third of its current business involves selling airline tickets. The company has also been trying to build its hotels business.

How does the deal help?

Skyscanner’s presence in 30 languages with 60 million monthly active users helps Ctrip achieve its larger aim—expanding its global reach. In October 2016, Ctrip had acquired three tour operators in the US with a similar aim:

- Universal Vision, a New York–based bus tour operator and travel agency

- Ctour, a Los Angeles–based wholesaler and China group-tour operator

- Tours for Fun, a Los Angeles–headquartered OTA focused on overseas destination travel

According to Ctrip’s new CEO, Jane Jie Sun, the Skyscanner acquisition could help strengthen Ctrip’s overseas air ticketing capabilities.

On the other hand, funding and technology capabilities from Ctrip.com should help Skyscanner grow its other businesses, including Hotels. Skyscanner’s strong front-end capabilities, combined with Ctrip’s strong back-end booking technology, could help spur its growth.

Investors can gain exposure to Ctrip.com by investing in the PowerShares NASDAQ Internet Portfolio ETF (PNQI), which invests 3.2% of its total holdings in Ctrip. PNQI also invests 8.2% in Priceline (PCLN), 3.5% in Expedia (EXPE), and 1.4% in TripAdvisor (TRIP).