What Are Analysts Recommending for Ctrip?

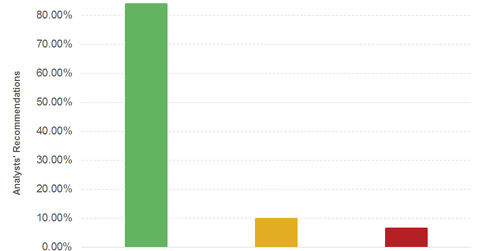

According to Reuter, of the 31 analysts tracking Ctrip, 26 analysts have issued a “buy,” while three have issued a “hold,” and two have issued a “sell.”

Nov. 21 2016, Updated 6:04 p.m. ET

Analyst views

According to a Reuter’s consensus, of the 31 analysts tracking Ctrip.com International (CTRP), 83.9% (26 analysts) have issued a “buy” recommendation on the stock, while 9.7% (three analysts) have issued a “hold,” and 6.5% (two analysts) have issued a “sell.”

Most analysts have maintained their rating for CTRP. Three analysts have initiated coverage on the stock after its 2Q16 results.

It’s important to be aware of analyst recommendations or changes to recommendations because they can significantly affect the company’s stock price. Changes to a popular analyst’s view can cause a significant short-term movement in the stock price.

Target Price

Ctrip.com’s consensus-12-month target price is $51.81, which indicates a 23.3% return potential based on its November 18, 2016, closing price of $42.02. The stock’s highest target price is $59.85, and the lowest target price is $27.43.

Ctrip’s target price at the end of 2Q16 was $51.87.

Analyst estimates

For 2016, analysts estimate sales to grow by 69% to $2.8 billion, including its new partnership with China’s second-largest OTA (online travel agency) player, Qunar (QUNR). For 2016, the company’s EBITDA (earnings before interest, tax, depreciation, and amortization) is expected to fall 189% to -$95, and its 2016 net income is expected to fall 191% to -$352 million, as compared to $385 million in 2015.

Notably, investors can gain exposure to Ctrip.com by investing in the PowerShares NASDAQ Internet Portfolio (PNQI), which invests 3.2% of its total holdings in Ctrip.com.

Continue to the next part for a look at Ctrip’s revenue growth prospects going forward.