U.S. Steel Bulls Left Heartbroken After 3Q16 Earnings Miss

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2.

Nov. 4 2016, Updated 1:51 p.m. ET

3Q16 earnings miss

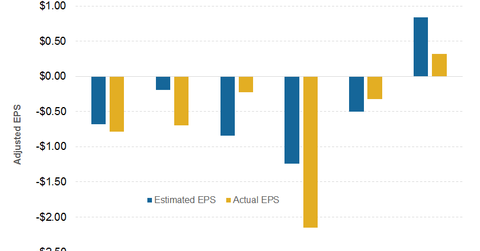

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2. The company reported an adjusted net income of $37 million, which translates into adjusted EPS (earnings per share) of $0.40.

U.S. Steel’s 3Q16 performance improved considerably from previous quarters. The company posted adjusted EPS of -$0.32 in 2Q16 and -$0.70 in 3Q15. Notably, 3Q16 marks the first time since 4Q14 when U.S. Steel generated a net profit. The company had posted a net loss for six consecutive quarters before 3Q16.

Setback for U.S. Steel bulls

However, U.S. Steel’s 3Q16 earnings fell well short of analysts’ estimates. Analysts polled by Bloomberg expected U.S. Steel to deliver EPS of $0.84 in 3Q16. U.S. Steel bulls (SSO) were left heartbroken after the company’s 3Q16 earnings release, and the stock fell 4.8% on November 2.

Series overview

We’re in the middle of the 3Q16 earnings season. Nucor (NUE), AK Steel (AKS), and Steel Dynamics (STLD) have already released their 3Q16 earnings results. ArcelorMittal (MT) is expected to release its 3Q16 earnings on November 8. You can read ArcelorMittal’s 3Q16 Earnings: What’s the Word on Wall Street to learn more about analysts’ expectations for MT’s 3Q16 earnings.

In this series, we’ll analyze U.S. Steel’s 3Q16 earnings. We’ll explore what drove U.S. Steel’s 3Q16 financial performance, and the key takeaways from the company’s earnings conference call. We’ll also analyze the business outlook and guidance provided by U.S. Steel. Let’s begin by looking at U.S. Steel’s 3Q16 revenue.