What Is Salesforce’s Value Proposition in the Software Space?

Earlier in this series, we discussed Salesforce’s (CRM) recently announced fiscal 1Q17 earnings. Now, let’s look at the company’s value proposition.

May 27 2016, Updated 9:05 a.m. ET

Salesforce’s scale in the Software space

Earlier in this series, we discussed Salesforce’s (CRM) recently announced fiscal 1Q17 earnings. Now, let’s look at the company’s value proposition compared to those of other companies in the US software space.

Let’s start with Salesforce’s size.

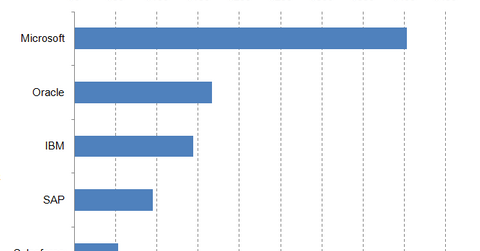

As of May 18, 2016, and as the above chart shows, globally, Microsoft (MSFT) was the largest player by market capitalization in the software space. It was followed by Oracle (ORCL).

IBM (IBM), SAP (SAP), and Salesforce are other prominent players in the software space.

Salesforce’s enterprise value multiples

Now let’s look at Salesforce’s EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple. We’ll also look at the multiples of other US software players.

Salesforce was trading at a forward EV-to-EBITDA multiple of ~24.68x on May 18, 2016. This metric was higher than Microsoft’s ~9.51x. The same metric was ~10.95x for SAP and 9.03x for Oracle.

Salesforce’s dividend yield

Microsoft’s forward annual dividend yield was ~2.9% as of May 18, 2016. Oracle’s and IBM’s forward annual dividend yields were ~1.5% and ~3.8%, respectively, as of May 18. Unlike its peers in the software space, Salesforce doesn’t pay dividends.

Investors who want to gain exposure to Salesforce can consider investing in the SPDR S&P 500 ETF (SPY). SPY has exposure of ~29% to application software. It invests ~0.23% of its holdings in Salesforce.

In the final part of our series, we’ll see what kind of recommendations analysts are giving for Salesforce.