Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

Nov. 29 2016, Updated 10:04 a.m. ET

RTG segment: 2Q17 performance

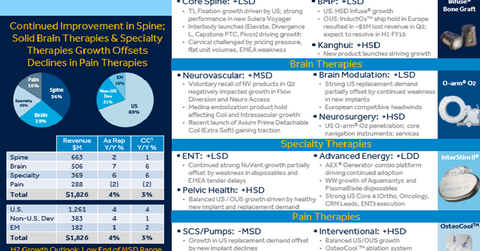

Medtronic (MDT) reported ~$7.3 billion in worldwide revenue in fiscal 2Q17. Of that total, ~$1.8 billion came from Medtronic’s RTG (Restorative Therapies Group) segment, representing ~25% of the company’s total revenues. These sales figures reflect a ~3% YoY (year-over-year) rise in fiscal 2Q17 on a constant currency basis.

In 2Q17, RTG’s sales growth in the United States was around 4%. Medtronic reported MITG segment sales of ~4% and ~1% in non-US developed markets and emerging markets, respectively, YoY. RTG’s brain therapies and specialty therapies business reported strong growth of ~7% and ~6% respectively. The continued momentum in spine sales led to spine sales growth of ~2%. However, the pain therapies business registered a sales decline of ~2%. (For more on this, check out Market Realist’s “Analyzing Medtronic’s Restorative Therapies Group Segment.”)

Medtronic’s major competitors in this segment include Stryker (SYK), Boston Scientific (BSX), and Zimmer Biomet Holdings (ZBH), which reported YoY sales growth of 17.1%, 11.5%, and 4%, respectively, in recent quarters. The iShares Russell 1000 Value ETF (IWD) invests approximately 1% of its total holdings in MDT.

Growth drivers

RTG registered strong sales in 2Q17 driven by solid performances by the group’s brain therapies and specialty therapies business along with the continued growth in spine sales. Medtronic has been gaining spine market share around the globe and registered its strongest growth during the past two years. The business saw the continued adoption of Medtronic’s INFUSE and other key launches, along with the strong adoption of the company’s surgical synergy strategy.

Medtronic’s “surgical synergy” strategy is “an initiative enabling the company to integrate its various enabling technology platforms, such as its intraoperative imaging, navigation, power tools and robotics systems, with its medical device portfolio at the procedural level.” The sales decline in the pain therapies business was mainly due to competitive pressures leading to a loss of market share.

In the next article in this series, we’ll discuss the fiscal 2Q17 performance of Medtronic’s Diabetes segment.