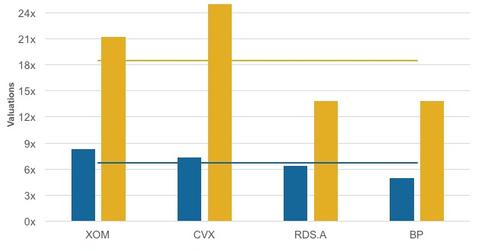

Integrated Energy Stocks’ Post-3Q16 Forward Valuations

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages.

Nov. 18 2016, Updated 11:04 a.m. ET

Integrated energy stocks’ forward valuations

The forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] and price-to-earnings (or PE) averages of ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP)—the four top integrated energy companies we’ve been analyzing in this series—stand at 6.8x and 18.5x, respectively.

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages. Similarly, CVX trades above peer averages on both parameters. However, Shell and BP trade below their peer averages on both parameters.

For exposure to XOM and CVX, you can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~15% exposure to both stocks.

To see which integrated energy stock has a higher institutional holding, continue to the next part.