Berenberg Rated Delphi Automotive as a ‘Hold’

Delphi Automotive (DLPH) has a market cap of $18.1 billion. It fell 2.5% to close at $66.98 per share on November 22, 2016.

Nov. 24 2016, Updated 3:04 p.m. ET

Price movement

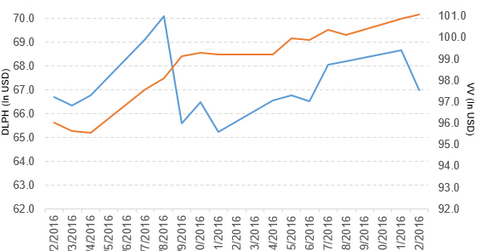

Delphi Automotive (DLPH) has a market cap of $18.1 billion. It fell 2.5% to close at $66.98 per share on November 22, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.31%, 4.7%, and -20.5%, respectively, on the same day.

DLPH is trading 1.1% above its 20-day moving average, 0.59% below its 50-day moving average, and 1.1% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. The YTD price movement of VV was 9.8% on November 22.

The market caps of Delphi Automotive’s competitors are as follows:

DLPH’s rating

On November 22, 2016, Berenberg initiated its coverage of Delphi Automotive with a “hold” rating and set the stock’s price target at $70.00 per share.

According to analyst Fei Teng, “Delphi is successfully repositioning itself into a high growth, high margin business through M&A and cost optimisation, and stands as one of the best quality businesses within its peer group. Its growth profile, margin resilience and best-in-class cash generation supports our constructive view of the company, but we also see downside risk to growth and pricing in its Powertrain division.

“On balance, we see Delphi as a high quality business with resilience to a volume downturn, but are wary of incremental political risk around emissions legislation and potential trade barriers with Mexico following the US election results.”

Performance of Delphi Automotive in 3Q16

Delphi Automotive (DLPH) reported 3Q16 net sales of $4.1 billion, a rise of 13.9% compared to its net sales of $3.6 billion in 3Q15. Sales in its Electrical/Electronic Architecture, Powertrain Systems, and Electronics & Safety segments rose 17.8%, 1.2%, and 14.2%, respectively, in 3Q16 compared to 3Q15. The company’s operating margin narrowed 150 basis points in 3Q16 compared to 3Q15.

Its net income and EPS (earnings per share) fell to $293.0 million and $1.07, respectively, in 3Q16, compared to $404.0 million and $1.42, respectively, in 3Q15. It reported adjusted EPS of $1.50 in 3Q16, a rise of 17.2% compared to 3Q15.

Delphi’s cash and cash equivalents fell 26.2%, and its inventories rose 16.4% in 3Q16 compared to 4Q15. Its current ratio rose to 1.34x, and its debt-to-equity ratio fell to 3.1x in 3Q16, compared to its current ratio and debt-to-equity ratio of 1.30x and 3.4x, respectively, in 4Q15.

During 3Q16, the company repurchased 1.5 million shares worth ~$100 million.

Projections

Delphi Automotive (DLPH) has made the following projections for 2016:

- revenue in the range of $16.4 billion–$16.5 billion

- adjusted operating income in the range of $2.16 billion–$2.19 billion

- adjusted EPS in the range of $6.00–$6.10

- cash flow from operations of $1.9 billion

- capital expenditure of $800 million

- adjusted effective tax rate of 17%

Next, we’ll look at Greif (GEF).