Analysts Are Truly Divided on Chemours after Its 3Q16 Earnings

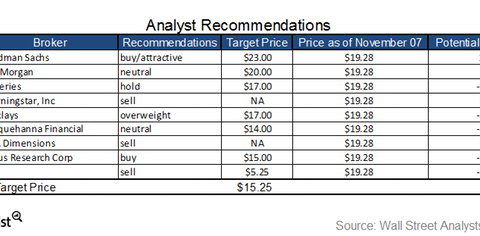

Among the analysts covering Chemours’ stock, 33.33% analysts recommended a “buy,” while 33.33% issued a “hold,” and the remaining 33.33% issued a “sell.”

Nov. 10 2016, Updated 11:04 a.m. ET

Analyst consensus

Analysts are truly divided on Chemours following the company’s 3Q16 earnings. Only a few analysts have changed their recommendations after the earnings release. Among the analysts covering the stock, 33.33% analysts have recommended a “buy,” while 33.33% have recommended a “hold,” and the remaining 33.33% have recommended a “sell.”

The consensus indicates a 12-month target price for of $15.25, which implies a potential one-year return of -20.9% based on the stock’s closing price of $19.28 on November 7, 2016.

Individual brokerage firms

Individual recommendations from brokerage firms include the following:

- On November 8, Goldman Sachs (GS) rated Chemours as “buy/attractive,” with a 12-month target price of $23.00, which implies a potential one-year return of 19.30%, as compared to $19.28 on November 7.

- On November 8, J.P. Morgan (JPM) rated Chemours as “neutral,” with a price target of $20.00, which implies a 12-month potential return of 3.7%, based on the closing price of $19.28 on November 7.

- On November 7, Barclays (BCS) gave an “overweight” rating to Chemours, with a price target of $17.00, which implies a 12-month potential return of -11.8% over the November 7 closing price of $19.28

Notably, investors can indirectly hold Chemours by investing in the PowerShares DWA Basic Materials Momentum Portfolio (PYZ), which had 6.0% of its holdings in Chemours on November 7, 2016.