Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

Dec. 6 2017, Updated 10:30 a.m. ET

Correlation analysis

A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement.

Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) are correlated to gold.

The VanEck Merk Gold Trust (OUNZ) and the PowerShares DB Gold Fund (DGL) have seen an upside in the price of 10.8% and 10%, respectively, on a YTD basis.

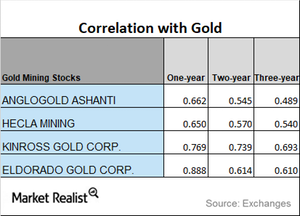

Correlation trends

Among the four miners we’re examining, Yamana Gold had the highest correlation to gold during the past year, while Barrick Gold had the lowest correlation.

Among the four miners, only Yamana Gold has seen an upward trend in the correlation to gold during the past three years. Barrick Gold has seen a downward trend in the correlation. Yamana Gold’s correlation has risen from a 0.71 three-year correlation to a 0.91 one-year correlation. A correlation of 0.91 suggests that ~91% of the time, Yamana Gold has moved in the same direction as gold during the past year.

Barrick Gold’s correlation has fallen from a 0.56 three-year correlation to a 0.52 one-year correlation. However, the correlation trends can keep changing.