REER 101: An Introduction to Real Effective Exchange Rates

The International Monetary Fund defines REER as an average of the bilateral real exchange rates between a country and its trading partners, weighted by their respective trade shares.

Nov. 20 2020, Updated 4:52 p.m. ET

Additionally, the exchange rates described above (both nominal and real) only reflect the foreign currency’s value against one other currency (e.g., the U.S. dollar). It may be more informative to compare a currency against all of a country’s trading partners in order to assess overall value. One measure that practitioners often look to is the real effective exchange rate (REER). The REER takes inflation into account, and is a more comprehensive measure of a country’s whole economy as it is a weighted average of bilateral exchange rates. REER is expressed as an index, and represents changes in price rather than absolute prices.

The interpretation of changes in REERs is not necessarily straightforward, because changes in the value of a currency can be caused by both long-term fundamental changes within an economy as well as shorter term factors. For example, does a declining REER indicate value or structural changes that have fundamentally reduced competitiveness? Further, price competitiveness of a country can be both a cause and effect of economic conditions, so linking movements in the REER to economic performance can be challenging. Additionally, several assumptions go into the calculation, including the measure of inflation that is used.

We believe REERs do, however, convey important information and are a good place to start when examining a currency, and movements may signal changes in fundamental or relative value. All else being equal, a rising REER means that a country’s goods are becoming more expensive, and therefore less competitive, relative to its trading partners. As a result, a country’s imports would be expected to increase which could lead to a wider current account deficit. A very rapid increase might precede balance of payments difficulties. On the other hand, a declining REER means a country’s goods are less expensive, and exports would be expected to increase.

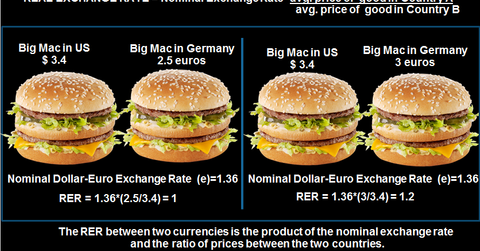

Market Realist – The graph above illustrates a simplified example of how to calculate real exchange rates for two countries. The International Monetary Fund defines REER as an average of the bilateral real exchange rates between a country and its trading partners, weighted by their respective trade shares. What’s interesting to note is that, even though transportation costs and tariffs have fallen over the years and consumption baskets have become more standardized, REER fluctuations have only increased.

As the IMF noted, “A century ago, among advanced economies (EFA), REER fluctuations were within a 30 percent band. In the 1980s, the United States (VTI) experienced swings in its REER as wide as 80 percent! Other countries have had similar experiences.”

The IMF has identified factors beyond tastes, tariffs, and transportation costs that cause fluctuations in REER:

- innovation and technological advances that enhance productivity and lower production costs and, consequently, the prices of tradeables

- the ratio of tradeable to non-tradeable in a country’s consumption basket

- persistent changes in terms of trade

- differences in fiscal policies, tariffs, and financial development.

A country’s REER is indeed a significant measure when it comes to gauging its trade potential and balance. REER can be a much better and more effective gauge of currency movements for international investors than simply nominal exchange rates.

In the next parts of this series, we’ll discuss how investors can seek out opportunities in local currency emerging market bonds (EMLC).