Take a Look at Fund Flows in MLP ETFs Last Week

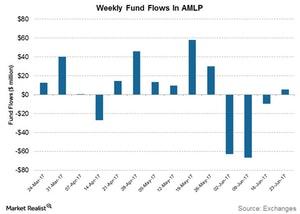

After three weeks of negative flows, the Alerian MLP ETF (AMLP) witnessed a net inflow of $5.6 million for the week ended June 23, 2017.

June 27 2017, Updated 9:08 a.m. ET

Net flows into MLP ETFs last week

After three weeks of negative flows, the Alerian MLP ETF (AMLP) witnessed a net inflow of $5.6 million for the week ended June 23, 2017. Some of the other MLP ETFs also saw a net inflow of funds last week. The First Trust North American Energy Infrastructure Fund (EMLP) and the InfraCap MLP ETF (AMZA) received a net inflow of $27.9 million and $1.8 million, respectively, last week.

However, there was a net outflow of $12.9 million from the Global X MLP ETF (MLPA) last week. AMLP has seen a net outflow of $133 million so far in June 2017.

It was a happening week again on the MLP rating front. Let’s take a look at the recent key rating changes for MLPs in the next part of this series.