Jefferies Is Rating Harley-Davidson a ‘Hold’

Harley-Davidson (HOG) has a market cap of $9.4 billion. It rose 0.21% to close at $52.59 per share on September 30, 2016.

Oct. 3 2016, Published 11:47 a.m. ET

Price movement

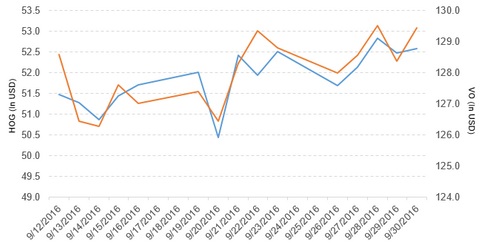

Harley-Davidson (HOG) has a market cap of $9.4 billion. It rose 0.21% to close at $52.59 per share on September 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.13%, 0.46%, and 18.7%, respectively, on the same day.

HOG is trading 1.4% above its 20-day moving average, 0.84% above its 50-day moving average, and 13.1% above its 200-day moving average.

Related ETFs and peers

The Vanguard Mid-Cap ETF (VO) invests 0.27% of its holdings in Harley-Davidson. VO tracks the CRSP US Mid-Cap Index, a diversified index of mid-cap US companies. VO’s YTD price movement was 8.9% on September 30, 2016.

The Vanguard Large-Cap ETF (VV) invests 0.04% of its holdings in Harley-Davidson. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market.

The market caps of Harley-Davidson’s competitors are as follows:

Harley-Davidson’s rating

Jefferies has initiated coverage of Harley-Davidson with a “hold” rating and set the stock’s price target at $49 per share.

Performance in 2Q16

Harley-Davidson reported 2Q16 motorcycles and related product revenues of ~$1.70 billion, a rise of 1.2% from $1.65 billion in 2Q15. The company’s retail sales in the United States and Latin America fell 5.2% and 5.0%, respectively, compared to 2Q15. Its retail sales in Canada, EMEA (Europe, the Middle East, and Africa), and Asia-Pacific rose 2.0%, 8.2%, and 0.75%, respectively, between 2Q15 and 2Q16.

Harley-Davidson’s financial services revenue was $191 million in 2Q16, a rise of 10% over the same period last year. The company’s gross profits and operating income from motorcycles and related products fell 7.2% and 10.9%, respectively, between 2Q15 and 2Q16.

Its net income fell to $280.4 million, and its EPS (earnings per share) rose to $1.55 in 1Q16 compared to $299.8 million and $1.44, respectively, in 1Q15. Its cash and cash equivalents and finance receivables both rose 19.7%, and its inventories fell 36.6% between 4Q15 and 1Q16. Its current ratio rose to 1.7x in 1Q16 from 1.4x in 4Q15. It reported a long-term debt-to-equity ratio of 2.6x in both 4Q15 and 1Q16.

Projections

The company has made the following projections for 2016:

- motorcycle shipments of 264,000—269,000, a rise of -1% to 1% from 2015

- operating margin of 15%–16% for its Motorcycles segment

- capital expenditure of $255 million–$275 million

- effective tax rate of ~33%

The company has projected motorcycle shipments of 49,000–54,000 for 3Q16.

In the next part of this series, we’ll take a look at Owens-Illinois (OI).