Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

Oct. 4 2016, Updated 8:05 a.m. ET

Market Realist: All these different strategies like Dividend Achievers or Momentum, do you think that they lie somewhere within the capital pricing model, or do they reside above that line? Meaning, are they truly alpha products over the long term or do they have a more detailed risk reward ratio for investors to be able to take advantage of?

Dave: The difference between smart beta and the benchmarks is that smart beta strategies are designed to generate alpha. That’s the point of the “smart” element. By changing our risk-return profile, our goal is to improve returns by either generating a higher degree of return irrelevant of risk, or perhaps reduce risk, and use that lower risk to generate a higher return. In short, smart beta seeks out that goal of outperformance or generating alpha, and that is always rooted against a core benchmark.

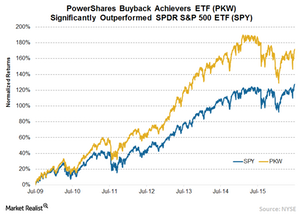

For example, we’ve seen historically if you buy stocks that have reduced their share count by over 5% over the last calendar year, as is done in the Nasdaq US Buyback Achievers Index that is tracked by the PowerShares Buyback Achievers ETF (PKW), we observe significant outperformance versus the benchmark on a risk-adjusted basis over 10 or 15 years. We have generated pure alpha by employing this smart beta strategy.

Market Realist: Especially in a very low interest rate environment where companies are going to continue buying back their shares.

Dave: Historically, looking at the data back to the mid-80s, we have seen Buybacks perform very well across all interest rate environments.

Market Realist: We’ve been on a continuous downward cycle or trend in interest rates since the 80s, but that’s a whole other conversation. To your earlier point that money managers have been employing these methodologies for years, and now investors really have the tools to encapsulate these strategies in a very systematic way: this serves both as a tool for their own portfolio optimization but also to benchmark and evaluate their managers. Have you noticed a trend in capital flowing away from the hedge funds that are charging 2 & 20 and into smart beta products, such as the ones that use Nasdaq indexes?

Dave: Yes, we’ve definitely observed this trend. Just from the growth that Nasdaq has seen on the ETFs linked to our indexes over the last number of years, we have definitely known that those assets are coming from other areas. We know the end-user community is starting to look to these vehicles for a variety of benefits: cost efficiency, tax benefits, liquidity from a trading perspective, and utilizing ETFs to implement their strategies vs. the traditional 2 & 20 hedge fund.

I believe that the traditional mutual fund area of active stock picking will get squeezed. The really good managers will move into the hedge fund world, and the rest will move into the passive ETF rules-based world. The success of product providers like Vanguard, BlackRock and others in the ETF community like First Trust and PowerShares is really indicative of the fact that the middle is getting squeezed out. I think it’s really a result of the advancement of widespread access to financial data and computing power.

Market Realist: Are there justifiable reasons for investors to invest in mutual funds and get charged higher fees when they can just invest into very detailed strategies in the smart beta space?

Dave: A couple of factors keep active management relevant. First, people still chase performance. Performance chasing will never end – that’s human nature. And so, the notion of trying to find that next manager who is going to pick winning stocks will never go away. We all want to make more money with our investments. To do this, you have to outperform the market, otherwise you’re just keeping up. So you’re always seeking out those who are offering that. Thus, active managers who have a track record of outperformance will continuously get flows. That’s never going to go away, and I don’t think it should because there’s still the potential for value to be found.

However, the opportunity set is diminishing. The second part has to do more with the nuts and bolts of the finance community: the 401K or 403b platform, depending on your defined contribution plan, is traditionally mutual fund driven. Every 2 weeks, a lot of money by Americans get deposited into defined contribution plans, which gets invested into mutual funds. And, not every plan is dedicated to passive funds or to low cost products. Mutual funds still proliferate on the 401K side, which gives them a great advantage from an asset gathering perspective.