Berenberg Downgrades Boston Beer to ‘Sell’

Price movement Boston Beer (SAM) has a market cap of $1.9 billion. It fell 4.8% to close at $155.41 per share on October 14, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.3%, -5.5%, and -23.0%, respectively, on the same day. SAM is trading 0.16% above its 20-day moving average, 9.5% […]

Oct. 17 2016, Updated 10:05 a.m. ET

Price movement

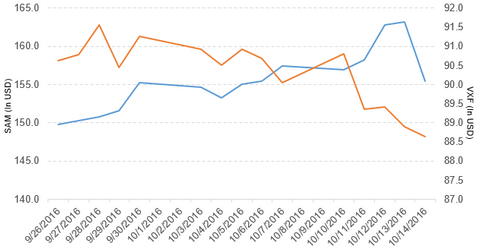

Boston Beer (SAM) has a market cap of $1.9 billion. It fell 4.8% to close at $155.41 per share on October 14, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.3%, -5.5%, and -23.0%, respectively, on the same day. SAM is trading 0.16% above its 20-day moving average, 9.5% below its 50-day moving average, and 9.8% below its 200-day moving average.

Related ETF and peers

The Vanguard Extended Market ETF (VXF) invests 0.05% of its holdings in Boston Beer. The ETF tracks a market-cap-weighted version of the S&P Total Market Index, excluding all S&P 500 stocks. The YTD price movement of VXF was 6.8% on October 14.

The market caps of Boston Beer’s competitors are as follows:

Boston Beer’s rating

On October 14, 2016, Berenberg has downgraded Boston Beer’s rating to “sell” from “hold” and set the stock’s price target at $135 per share.

Performance of Boston Beer in fiscal 2Q16

Boston Beer reported fiscal 2Q16 net revenue of $244.8 million, a fall of 2.9% from the $252.2 million reported in fiscal 2Q15. The company’s gross profit margin and operating income fell 4.0% and 10.7%, respectively, between fiscal 2Q15 and fiscal 2Q16. It sold 1.1 million barrels in fiscal 2Q16, a fall of 4.0% from fiscal 2Q15. Its net income and EPS (earnings per share) fell to $26.6 million and $2.06, respectively, in fiscal 2Q16, compared with $29.9 million and $2.18, respectively, in fiscal 2Q15.

Boston Beer’s cash and cash equivalents fell 70.7% and its inventories rose 8.3% between fiscal 4Q15 and fiscal 2Q16. Its current ratio fell to 1.5x and its debt-to-equity ratio rose to 0.43x in fiscal 2Q16, compared with 2.0x and 0.40x, respectively, in fiscal 4Q15.

Projections

The company has made the following projections for fiscal 2016:

- EPS of $6.40–$7

- gross margin of 50%–52%

- effective tax rate of ~36.3%

- depletion and shipments percentage change of -4%–0%.

Next, let’s take a look at Sony (SNE).