What Are the Analysts’ Recommendations for Microsoft?

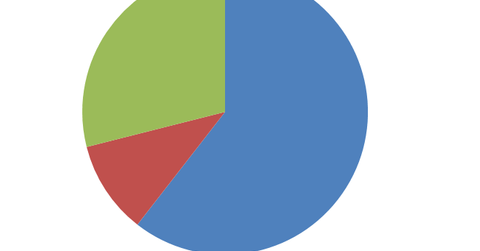

Of the 38 analyst recommendations on Microsoft’s stock, 60.5% were “buys” as of April 6. Meanwhile, ~29% of recommendations were “holds.” The remaining ~10.5% of recommendations on the stock were “sells.”

April 14 2016, Updated 11:06 a.m. ET

Wall Street analysts’ view on Microsoft

Earlier in this series, we looked at some aspects of Microsoft’s (MSFT) value proposition in the software industry in the United States. We explored the company’s forward dividend yield compared to those of its peers, including Oracle (ORCL), Red Hat (RHT), and ServiceNow (NOW), as of April 6, 2016.

We also looked at the forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples of these players, as well as Red Hat (RHT). Now, we’ll take a look at select market-centric views and metrics of Microsoft.

Let’s start with Wall Street analysts’ views on Microsoft. As we can see in the above chart, of the 38 analyst recommendations on Microsoft’s stock, 60.5% were “buys” as of April 6, 2016. Meanwhile, ~29% of recommendations were “holds.” The remaining ~10.5% of recommendations on the stock were “sells.”

The median target price set by analysts for Microsoft was $60.00 as of April 6. Microsoft’s closing price was $55.12 as of the same date.

Price performance of Microsoft

Microsoft’s stock price movement during the past month has been positive. As of April 6, 2016, during the past one-month timeframe, the company’s stock price has risen by 4.86%.

For diversified exposure to select software companies in the United States, you may want to consider investing in the SPDR S&P 500 ETF (SPY). This ETF has an exposure of 8% in the application software industry.