Micron’s Ability to Return to Profit Hindered by Market Forces

All market forces are in favor of Micron Technology (MU) and are likely to drive the company’s revenue up 10% sequentially in fiscal 4Q16.

Dec. 4 2020, Updated 10:53 a.m. ET

Micron’s profit margins in fiscal 4Q16

Earlier in the series, we saw that all market forces are in favor of Micron Technology (MU) and are likely to drive the company’s revenue up 10% sequentially in fiscal 4Q16. However, the company is unlikely to reach its 2014 revenue levels, as the overall semiconductor market is slowing.

Let’s see how increasing DRAM (dynamic random access memory) and NAND prices could impact Micron’s margins in fiscal 4Q16.

Gross margin

In fiscal 3Q16, Micron’s inventory rose 22.6% YoY (year-over-year) to $2.9 billion due to DRAM oversupply in the market and the company’s transition to 20nm (nanometer) DRAM. During this period, DRAM prices fell faster than costs, which had a negative impact on Micron’s non-GAAP (generally accepted accounting principles) gross margin. The margin fell from 31% in fiscal 3Q15 to 17% in fiscal 3Q16.

In fiscal 3Q16, Micron expected the same trend to continue in fiscal 4Q16, so it reported gross margin guidance in the range of 15.5%–18%. As demand and supply conditions have improved, the company now expects to report a gross margin of 18% or above in fiscal 4Q16.

On the inventory front, the company expects its inventory to remain flat in fiscal 4Q16, as increasing sales will likely be offset by increasing yields from its 20nm node.

Operating margin

On the operations front, Micron slipped to losses in fiscal 3Q16 as the reduction in its operating expenses was slower than the reduction in its revenue. The company expects its losses to continue in fiscal 4Q16, as it will bear a restructuring charge of $70 million.

However, the effects of restructuring will be visible in fiscal 2017, with an $80 million reduction in COGS (cost of goods sold) and operating expenses in each quarter. Intel (INTC), Advanced Micro Devices (AMD), and Qualcomm (QCOM) have also resorted to restructuring to improve their profits amid falling revenues.

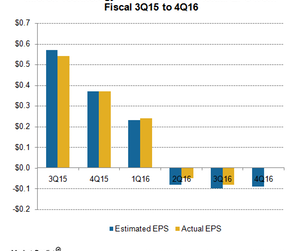

EPS

Micron expects to report non-GAAP earnings per share (or EPS) of -$0.06 in fiscal 4Q16, better than its earlier guidance of -$0.16. However, it expects its fiscal 2016 EPS to be $0.05.

Cash flow

The company’s negative EPS could reduce its operating cash flow further in fiscal 4Q16, leading to another quarter of negative free cash flow, as its capital expenditure will likely be above $1 billion.

Next, let’s look at the fundamentals of the two markets that drive Micron’s revenue: DRAM and NAND.