Why FedEx Sees Volume Growth in the Future of Its Freight Segment

FedEx’s (FDX) Freight segment revenues rose 4% from $1.6 billion in fiscal 1Q16 to ~$1.7 billion in fiscal 1Q17.

Sept. 26 2016, Updated 8:05 a.m. ET

FedEx Freight revenues in fiscal 1Q17

In the previous part, we looked at FedEx Ground’s fiscal 1Q17 revenues and their drivers. In this article, we’ll analyze the fiscal 1Q17 outcomes of FedEx’s (FDX) Freight segment.

FedEx’s (FDX) Freight segment revenues rose 4% from $1.6 billion in fiscal 1Q16 to ~$1.7 billion in fiscal 1Q17. Higher volumes from SME (small and medium enterprise) customers drove FedEx Freight’s revenues in fiscal 1Q17.

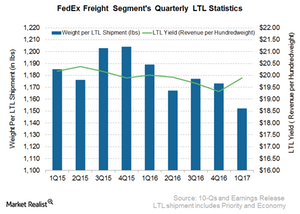

Although the overall segmental revenue increased, the revenue per LTL (less than truckload) shipment fell 4% due to reduced fuel surcharge revenues and lower weight per package. However, the average daily shipments rose 8% in fiscal 1Q17 on a year-over-year basis.

On the other hand, weight per LTL shipment in pounds fell 3% in fiscal 1Q17. The revenue per shipment fell 3.6% due to lower weight per shipment.

Management insights

The FedEx Freight segment offers LTL services across all haul lengths. This segment revenue also includes revenues of FedEx Custom Critical, which provides time-sensitive and critical shipment services in the US.

During its fiscal 1Q17 conference call, FedEx announced an increase of 4.9% in the FedEx Freight segment. Beginning in February 2017, FDX will be revising the fuel surcharges in this segment on a weekly basis.

The company expects higher FedEx Freight revenues in fiscal 2017 due to expected volume growth and improved base yield. The company also anticipates reasonable volume growth from small and medium-sized customers to increase this segment’s revenues over the next three quarters.

Investing in ETFs

Investors opting for investment in US transportation stocks—including airlines (DAL), railroads (CSX), trucking (JBHT), and other logistics companies (UPS)—can consider the First Trust Industrials/Producer Durables Alpha DEX ETF (FXR). Major US airlines and railroads make up 12.8% and 6.4%, respectively, of FXR.

In the next article, we’ll take a deep dive into the overall operating margins of FDX, along with a glance at its segmental margins.