WestRock Made Key Changes to Its Management

WestRock (WRK) fell 4.2% to close at $46.49 per share during the first week of September 2016.

Nov. 20 2020, Updated 4:36 p.m. ET

Price movement

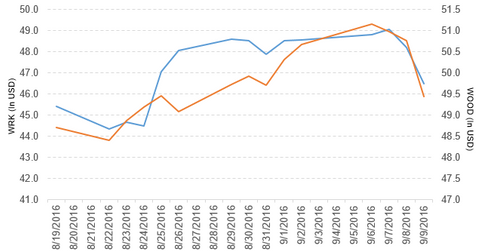

WestRock (WRK) fell 4.2% to close at $46.49 per share during the first week of September 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -4.2%, 6.0%, and 5.0%, respectively, as of September 9. WRK is trading 0.22% below its 20-day moving average, 7.4% above its 50-day moving average, and 16.6% above its 200-day moving average.

Related ETF and peers

The iShares Global Timber & Forestry ETF (WOOD) invests 3.9% of its holdings in WestRock. The ETF tracks the 25 largest publicly listed companies that own or manage forests and timberlands. The YTD price movement of WOOD was 3.5% on September 9. The market caps of WestRock’s competitors are as follows:

Latest news on WestRock

WestRock has announced several management changes.

- Bob Feeser has been appointed as president of Consumer Packaging and will report to Steve Voorhees, WestRock’s CEO. Feeser will take care of commercial activities and operations of its consumer paper and packaging businesses, innovation, and the Asia-Pacific region.

- Jeff Chalovich has been appointed as president of Corrugated Packaging and will report to Steve Voorhees, WestRock’s CEO. Chalovich will take care of the company’s Commercial Excellence organization, commercial activities, and operations of the containerboard mills and corrugated packaging facilities.

- Jim Porter has been appointed as president of business development and Latin America and will be responsible for the Brazil and forest resource organizations, customer relationships, and new investment and acquisition opportunities.

- Craig Gunckel has been appointed as president of Enterprise Solutions and will report to Steve Voorhees, WestRock’s CEO. Gunckel will provide support to marketing.

In a press release on September 8, 2016, WestRock “announced it will settle $2.5 billion in pension obligations of the WestRock Company Consolidated Pension Plan (“Plan”). This transaction, which is expected to close in late September and is subject to closing conditions, will occur through the purchase of a group annuity contract using Plan assets that will transfer payment responsibility for retirement benefits owed to approximately 35,000 U.S. retirees and their beneficiaries to The Prudential Insurance Company of America, a subsidiary of Prudential Financial, Inc. (PRU). This settlement will reduce WestRock’s overall U.S. pension obligations by approximately 40%.”

Performance of WestRock in fiscal 3Q16

WestRock reported fiscal 3Q16 net sales of $3.6 billion, a rise of 44.0% from the net sales of $2.5 billion in fiscal 3Q15. Sales from the corrugated packaging and consumer packaging segments rose 4.3% and 137.0%, respectively, between fiscal 3Q15 and fiscal 3Q16. It reported land and development sales of $42.0 million in fiscal 3Q16. It reported restructuring and other costs of $43.1 million in fiscal 3Q16, compared with $13.1 million in fiscal 3Q15. The company’s gross profit margin fell 2.4% and its operating profit rose 8.5% between fiscal 3Q15 and fiscal 3Q16.

Its net income and EPS (earnings per share) fell to $92.3 million and $0.36, respectively, in fiscal 3Q16, compared with $156.4 million and $1.10 in fiscal 3Q15. It reported adjusted EPS from continuing operations of $0.71 in fiscal 3Q16.

WRK’s cash and cash equivalents rose 24.5% and its inventories fell 4.0% between fiscal 3Q15 and fiscal 3Q16. Its current ratio fell to 1.7x, and its debt-to-equity ratio rose to 1.3x in fiscal 3Q16, compared with 1.9x and 1.2x, respectively, in fiscal 4Q15. For an ongoing analysis of this sector, please visit Market Realist’s Consumer Discretionary page.