Understanding Sanofi’s Strategic Priority

As of June 30, 2016, the animal health business was Sanofi’s operating segment. It will remain an operating segment until the transaction closes.

Sept. 8 2016, Published 11:18 a.m. ET

What’s Sanofi’s strategy to reshape its human health portfolio?

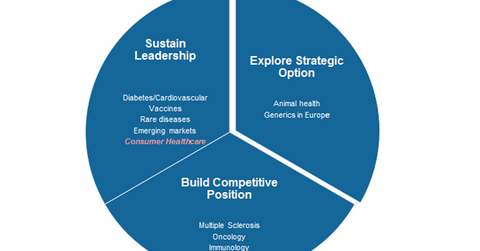

Sanofi (SNY) plans to reshape its human health portfolio by adapting a three-way strategy:

- Sustaining leadership in diabetes/cardiovascular, vaccines, rare diseases, and emerging markets

- Building a competitive position in multiple sclerosis, oncology, and the immunology business

- Exploring strategic alternatives for its animal health business as well as its European generics business

It plans to sustain its leadership position in the CHC (consumer healthcare) business. Earlier, CHC was part of the “build competitive position” strategy.

Discontinuing the animal health business

As of June 30, 2016, the animal health business was Sanofi’s operating segment. It presents the animal health business’s results as separate line element in its income statement. The business qualifies to be a discontinued operation under IFRS (International Financial Reporting Standards) 5. It will remain an operating segment until the transaction closes.

During 1H16, the Animal Health segment generated 1.5 billion euros—a jump by 10.1% on a reported basis. The US is the major market for the animal health business. It obtained 728 million euros during 1H16. It had a share of 49% of the segment’s total net sales.

In the CHC business, Sanofi competes with GlaxoSmithKline (GSK), Johnson & Johnson (JNJ), and Pfizer (PFE). In the next part, we’ll discuss Sanofi’s rationale behind its expansion in the CHC business.

Investors should note that direct investment in equity is very risky. To reduce the direct company-specific risk, you can invest in ETFs such as the VanEck Vectors Pharmaceutical ETF (PPH). PPH holds 4.8% of its assets in Sanofi.