Revival or Luck: Analysts’ Takes on Macao’s Revenue Rise

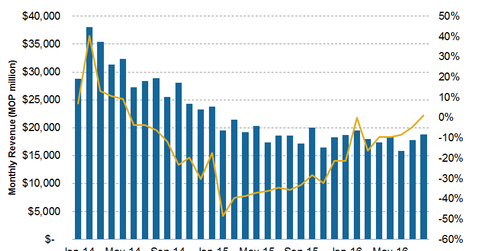

After 26 consecutive months of declining revenues, Macao gaming revenues have finally shown a small spurt of growth.

Sept. 13 2016, Updated 8:05 a.m. ET

Macao gaming revenues rise

After 26 consecutive months of declining revenues, Macao gaming revenues have finally shown a small spurt of growth. After reporting a 6% YoY (year-over-year) decline in July 2016, August revenues for Macao gaming companies have grown by 1% YoY to $2.4 billion. Revenues in August came in significantly above analyst expectations of a 1.5% decline.

During the first eight months of 2016, Macao revenues had declined 9.1% YoY.

June 2014, marked another high for Macao casinos when Chinese government came down strongly against corruption. This led Macao officials to impose stricter rules aimed at stopping illegal money siphoning. Since then, VIP rollers have been absent from the scene, leaving major casinos to vie for a piece of the mass market.

Since then, the rules have been getting stricter, further adding to the industry’s woes. These included tighter visa policies and a smoking ban.

Too early to call it a recovery?

Analysts are divided as to whether the growth in August was due to a revival or sheer luck. According to Galaxy Chairman, Lui Che-Woo, it’s still early to call it a recovery. A true recovery depends on how successful customers are at attracting the mass market, which will take time. However, Lui Che-Woo does agree that Macao has hit a bottom.

Expectations

Meanwhile, the analyst consensus states that September 2016 revenues could be flat YoY, given the opening of more new resorts and increased promotional activities by other casinos. J.P. Morgan expects September revenues in Macao to decline by 2%–3%, while Wells Fargo expects revenue growth to range in between -2%–2%.

Investors should also remember that September is historically a poor revenue month compared to August, with September revenues coming in 9% lower than in August.

Currently, Sands China (LVS), Wynn Resorts (WYNN), MGM China (MGM), Galaxy Entertainment, Melco Crown (MPEL), and SJM holdings are the major casino operators in Macao. Notably, the Vanguard Extended Market ETF (VXF) holds 0.45% in LVS.

In the next part, we’ll examine the role of Chinese tourists in the region.