Looking 2 Years Out, Energy Stocks Trade at Respectable PEs

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

Sept. 8 2016, Updated 11:05 a.m. ET

Integrated energy stocks’ valuations

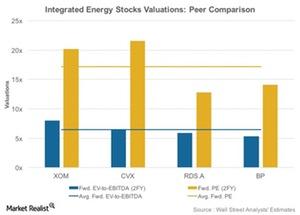

The two-year forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] and price-to-earnings (or PE) averages of ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP)—the four integrated energy companies we’ve been analyzing in this series—stand at 6.5x and 17.2x, respectively.

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

On the other hand, RDS.A and BP trade lower than the peer averages on both valuation metrics. Chevron trades at a PE ratio of 21.6x, well above the peer average. However, CVX trades in line with the average EV-to-EBITDA. The iShares North American Natural Resources ETF (IGE) has an ~22% exposure to the sector.

To see which integrated energy stock has a higher institutional holding, continue to the next part.