What Hurdles Could Monsanto-Bayer Deal Face?

A few days ago, Monsanto (MON) agreed to Bayer’s takeover offer of $128 per share for a total deal value of $66 billion.

Nov. 20 2020, Updated 12:28 p.m. ET

Investors are skeptical

A few days ago, Monsanto (MON) agreed to Bayer’s takeover offer of $128 per share for a total deal value of $66 billion. However, we saw previously that despite the confirmation of this deal, Monsanto’s shares were trading at a significant discount to the takeover price.

Antitrust hurdles

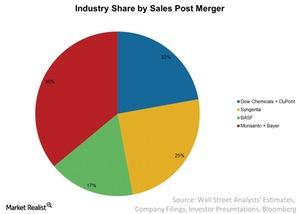

The Monsanto-Bayer merger faces an uphill challenge to overcome antitrust hurdles. Together, both Bayer and Monsanto will merge to form an agricultural giant that will represent about 36% of the market share (MOO) post-merger. Dow Chemicals (DOW) and DuPont (DD), which merged earlier this year, will command a 22% share, and Syngenta (SYT) will have a 25% share post-merger with ChemChina.

Before we discuss more about why investors are skeptical, let’s understand what antitrust means. Antitrust laws are put in place by regulators in a free market economy to ensure there are enough companies that offer a product or a service. In other words, no single company has a monopoly. This ensures that the pricing power is not concentrated on the supply side, which may take undue advantage of its monopolistic position and squeeze out the demand side.

Antitrust laws are a major cause of concern, which is why investors are skeptical that this deal will come to fruition. These worries were evident in Monsanto’s stock price on September 15. This deal will likely take one year to close.

However, Bayer is confident that it will overcome this challenge and has committed to a $2 billion reverse antitrust break fee for Monsanto if the deal doesn’t get regulatory approvals. Also, Bayer also stated that it is “committed to undertake a certain level of divestitures if required by regulatory authorities.”

Market Realist will track developments in this merger. In the meantime, you can find more industry-related news on our agricultural sector page.