How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

Sept. 9 2016, Updated 11:04 a.m. ET

Wells Fargo’s interest rate sensitivity

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion. By comparison, peers Bank of America (BAC), JPMorgan Chase (JPM), and Citigroup (C) had loans of $903 billion, $872 billion and $592 billion, respectively. This makes Wells Fargo’s earnings extremely sensitive to interest rate changes.

Banks with more commercial loans, which often have floating rates that rise with the Fed’s interest rate, will profit most from higher interest rates. Rates on mortgages, however, are often fixed for many years.

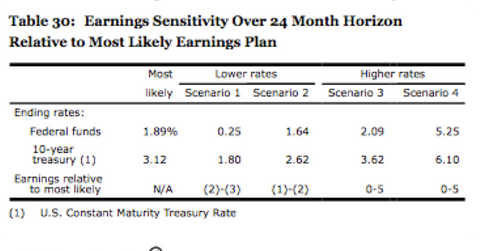

In its latest 10-Q filing, Wells Fargo measures interest rate risk by simulating earnings under various interest rate scenarios. If the federal funds rate moved lower to 0.25%, or 1.64% from the current level of 1.89%, Wells Fargo’s earnings would decline by 2%–3% and 1%–2%, respectively. But if the federal funds rate moved higher to 2.09% or 5.25%, its earnings would grow by 0%–5%.

Similarly, Wells Fargo also created scenarios using the ten-year treasury yield curve. If ten-year yields moved lower to 1.8% or 2.62%, its earnings would decline by 2%–3% and 1%–2%, respectively. However, if ten-year yields rose to 3.6% or 6.1%, Wells Fargo’s earnings are projected to rise 0%–5%.

Notably, a parallel 100-basis-point rise in interest rates would add $2.4 billion to Wells Fargo’s net interest income and lead to a rise of 5–15 basis points in its net interest margins.

Continue to the next part for a look at Citigroup.