How Zimmer Biomet Stock Has Performed Recently

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20.

June 5 2017, Updated 7:36 a.m. ET

Stock performance

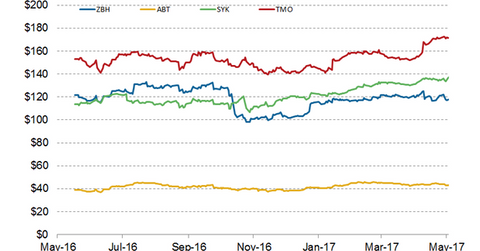

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20. As of May 30, 2017, ZBH stock was trading ~30.0% above its 52-week low of $95.60 on November 14, 2016. It was trading approximately -7.4% below its 52-week high of $133.20 on October 10, 2016.

The company’s share price has fallen about 5.4% since the release of its 1Q17 earnings on April 27, 2017. In 1Q17, Zimmer Biomet exceeded analysts’ estimates and posted strong results. However, ZBH stock fell ~6.0% after the announcement since the company lowered its 2017 guidance.

As of May 30, 2017, Zimmer Biomet’s peers Stryker (SYK), Thermo Fisher Scientific (TMO), and Abbott Laboratories (ABT) generated returns of about 28.0%, 13.6%, and 16.2%, respectively, over the last 12 months.

Comparisons with industry and market performances

Zimmer Biomet Holdings stock has returned approximately -3.1% in the past 12 months, underperforming the SPDR S&P 500 Index (SPY), which returned ~15.0% during the same period. But recently, the company has been recovering from the weakness in its stock.

ZBH’s stock performance can also be compared to the US medical device sector’s performance as represented by the iShares US Medical Devices (IHI). Zimmer Biomet has returned ~15.5% on a year-to-date basis, which compares to 7.8% and 21.0% year-to-date returns for SPY and IHI, respectively.

In the last part of this series, we’ll look at analysts’ recommendations for ZBH stock.