Harley-Davidson Rose Again on Rumors

Harley-Davidson (HOG) rose 1.6% to close at $52.52 per share during the third week of September 2016.

Sept. 26 2016, Updated 6:04 p.m. ET

Price movement

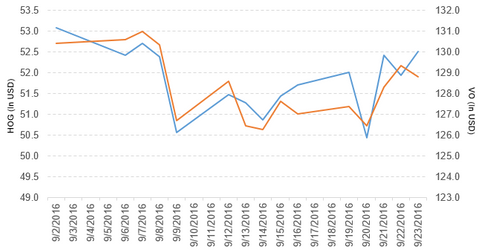

Harley-Davidson (HOG) rose 1.6% to close at $52.52 per share during the third week of September 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 1.6%, -0.95%, and 18.5%, respectively, as of September 23, 2016.

HOG is trading 1.2% above its 20-day moving average, 1.5% above its 50-day moving average, and 13.4% above its 200-day moving average.

Related ETFs and peers

The Vanguard Mid-Cap ETF (VO) invests 0.27% of its holdings in Harley-Davidson. VO tracks the CRSP US Mid Cap Index, a diversified index of mid-cap US companies. VO’s YTD price movement was 8.3% on September 23, 2016.

The Vanguard Large-Cap ETF (VV) invests 0.04% of its holdings in Harley-Davidson. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market.

The market caps of Harley-Davidson’s competitors are as follows:

Latest news on Harley-Davidson

There are again rumors about Harley-Davidson being a buyout target of Kohlberg Kravis & Roberts (KKR), a private equity firm. This speculation made HOG share prices rise on September 21, 2016.

There was the same speculation on July 1, 2016, and in 2010 that KKR was going to acquire Harley-Davidson. But the deal didn’t take place.

Performance in 2Q16

Harley-Davidson reported 2Q16 motorcycles and related product revenues of ~$1.7 billion, a rise of 1.2% from the $1.65 billion it reported in 2Q15. The company’s retail sales in the United States and Latin America fell 5.2% and 5.0%, respectively, over 2Q15. Its retail sales in Canada, EMEA (Europe, the Middle East, and Africa), and Asia-Pacific rose 2.0%, 8.2%, and 0.75%, respectively, between 2Q15 and 2Q16.

Harley-Davidson’s financial services revenue was $191 million in 2Q16, a rise of 10% over the same period last year. The company’s gross profits and operating income from motorcycles and related products fell 7.2% and 10.9%, respectively, between 2Q15 and 2Q16.

Its net income fell to $280.4 million, and its EPS (earnings per share) rose to $1.55 in 1Q16, compared to $299.8 million and $1.44, respectively, in 1Q15. Its cash and cash equivalents and finance receivables both rose 19.7%, and its inventories fell 36.6% between 4Q15 and 1Q16. Its current ratio rose to 1.7x in 1Q16 from 1.4x in 4Q15. It reported a long-term debt-to-equity ratio of 2.6x in both 4Q15 and 1Q16.

Projections

The company has made the following projections for 2016:

- motorcycle shipments of 264,000—269,000, a rise of -1% to 1% from 2015

- operating margin of 15%–16% for the Motorcycles segment

- capital expenditure of $255 million–$275 million

- effective tax rate of ~33%

The company has projected motorcycle shipments of 49,000–54,000 for 3Q16.

In the next part of this series, we’ll take a look at B&G Foods (BGS).