Emerging Market Debt Outperforms Other Risk Assets

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns.

Sept. 27 2016, Updated 8:05 a.m. ET

Spread Tightening Boosts Hard Currency Bonds

In August, hard currency sovereign bonds returned 1.79%, outperforming local currency sovereign bonds, which returned 0.04% (all returns are stated in U.S. dollar terms), and corporates which returned 1.18%. Returns of hard currency bonds were driven by a tightening of spreads over U.S. Treasuries. Local currencies detracted from positive local bond returns as the U.S. dollar showed strength amid expectations of a rate increase.

Latin America was the highest returning region among hard currency sovereign bonds. Both Peru and Colombia released positive economic data, with the latter also benefiting from the peace process. Bonds issued by Mexico were also top performers, despite a cut to the country’s credit rating outlook. Laggards included Mongolia, South Africa, and Chile.

Also of note within the hard currency bond universe is the relative performance of emerging markets high yield corporate debt. At 14.75% total return through the end of August, the sector is performing in line with U.S. high yield, which has returned 14.58%, and is 600 basis points ahead of emerging markets investment grade corporates which have returned 9.35% year-to-date. Emerging markets high yield corporates were still yielding above 7% at the end of August and provided 107 basis points pick-up versus U.S. high yield in option adjusted spread terms. Emerging markets high yield corporates currently have a one notch higher average credit rating than U.S. high yield and a shorter duration as well (3.74 vs. 4.20). That said, the spread pickup over U.S. high yield is near its lowest level since early 2013.

Among local currency sovereign bonds, Colombia, Russia, and the Philippines all experienced currency appreciation, adding to positive local bond returns. South Africa, Chile, and Indonesia were laggards. Chile’s government is dealing with an economic slowdown and rising pension costs. The ability to address these issues is in question given the unpopularity of the current government.

Market Realist – Emerging market bonds outperform their developed market peers

While around 30% of developed market bonds (IHY) are trading at negative yields, emerging market debts (HYEM) are offering attractive returns. The Bloomberg Barclays Emerging Markets Local Currency Index has risen 15.7% year-to-date (or YTD), while the Bloomberg Barclays Emerging Markets Hard Currency Aggregate Index has risen 11.6% YTD.

The Latin America region provided one of the highest returns in the emerging markets space, with the Bloomberg Barclays EMs LatAm TR Index rising 17.1% YTD. The Bloomberg Barclays EMs High Yield TR Index also returned a handsome 15.6% YTD.

Higher fund flows

This relative outperformance led to a sharp rise in fund flows to emerging market debt (EMB) (PCY). Following the United Kingdom’s vote to exit the European Union, investors put over $16 billion into emerging market bond funds, much more than they put into other risky assets.

Though these inflows mainly went into hard currency bonds, local currency bonds (EMLC) have also seen higher demand.

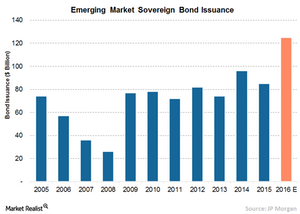

Surging bond issuance

Bond issuances from emerging markets have also risen continuously during the year. Countries such as Qatar, Saudi Arabia, Mexico, and Argentina have issued bonds worth $90 billion in 2016. JPMorgan Chase expects this figure to rise to around $125 billion—a record high—by the year’s end.

Even pension funds and insurance companies seeking higher yields have invested in emerging market bonds. According to data from eVestment, around $510.7 billion worth of institutional assets have been injected into emerging market debt since June 30, 2016, a rise of 8% over December’s end.

Emerging market companies have also been active in the bond market in 2016. According to Citigroup, corporates in emerging markets have issued bonds worth $153 billion YTD, a rise of 7% year-over-year.

Improving fundamentals

With the introduction of economic reforms in many emerging markets and the prospect of improving economies, investors’ risk appetites have also improved significantly. Rising credit quality and falling risk premiums make emerging market bonds more appealing to investors seeking higher yields.