Delphi Automotive Issues Senior Notes Due 2028

Delphi Automotive (DLPH) has a market cap of $19.3 billion. It rose by 0.36% to close at $70.66 per share on August 31, 2016.

Sept. 2 2016, Updated 8:05 a.m. ET

Price movement

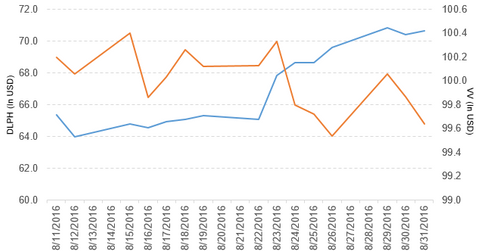

Delphi Automotive (DLPH) has a market cap of $19.3 billion. It rose by 0.36% to close at $70.66 per share on August 31, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 2.9%, 8.7%, and -16.5%, respectively, on the same day. DLPH is trading 6.7% above its 20-day moving average, 7.3% above its 50-day moving average, and 0.03% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 7.6% on August 31.

The market caps of Delphi Automotive’s competitors are as follows:

Latest news on Delphi Automotive

In a press release on August 31, 2016, Delphi Automotive reported, “Delphi Automotive PLC (DLPH), a leading global technology company serving the automotive sector, today announced it priced €500 million aggregate principal amount of its 1.600% Senior Notes due 2028.”

It also added that “the Notes will be issued at a price of 99.881% of their principal amount. Proceeds from the Notes will be used to repay a portion of Delphi’s existing $800 million 5.00% Senior Notes due 2023.”

Performance of Delphi Automotive in 2Q16

Delphi Automotive reported 2Q16 net sales of $4.2 billion, a rise of 7.7% from the net sales of $3.9 billion in 2Q15. Sales of the Electrical and Electronic Architecture and Electronics and Safety segments rose by 15.1% and 9.0%, respectively. Sales of the Powertrain Systems segment fell by 2.2% between 2Q15 and 2Q16. It reported a restructuring expense of $154.0 million in 2Q16, compared with $17.0 million in 2Q15. The company’s cost of sales as a percentage of net sales and operating income fell by 1.2% and 18.7%, respectively.

Its net income and EPS (earnings per share) fell to $258.0 million and $0.94, respectively, in 2Q16, compared with $645.0 million and $2.23 in 2Q15. It reported adjusted EPS of $1.59 in 2Q16, a rise of 18.7% from 2Q15.

Delphi’s cash and cash equivalents fell by 18.3% and its inventories rose by 11.6% between 4Q15 and 2Q16. Its debt-to-equity ratio fell to 3.3x in 2Q16 from 3.4x in 4Q15. It reported a current ratio of 1.3x in 4Q15 and 2Q16. During 2Q16, the company repurchased 0.89 million shares worth ~$65 million. Currently, it has ~$1.6 billion for future share repurchases.

Projections

The company made the following projections for fiscal 3Q16:

- revenue of $3.9 billion–$4.0 billion

- adjusted operating income of $505 million–$525 million

- adjusted EPS of $1.38–$1.44

- adjusted effective tax rate of 17%

The company made the following projections for fiscal 2016:

- revenue of $16.3 billion–$16.5 billion

- adjusted operating income of $2.15 billion–$2.20 billion

- adjusted EPS of $5.95–$6.05

- cash flow from operations of $1.9 billion

- capital expenditures of $750 million–$800 million

- adjusted effective tax rate of 17%

Next, we’ll look at Coca-Cola (KO).