Could China’s Iron Ore Imports Pull Back in the Near Term?

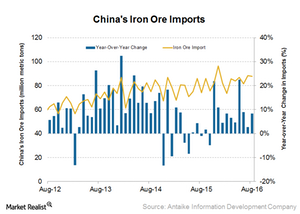

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

Sept. 30 2016, Updated 11:05 a.m. ET

China’s iron ore imports

In August 2016, China’s iron ore imports were 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016. Iron ore imports in the first eight months of 2016 were 670 million tons, which was 9% higher than the same period in 2015. The recent price rally in Chinese steel prices is the main reason for the buoyant iron ore imports.

Customs data and China’s iron ore imports

China tracks its iron ore imports through customs data. This is important for investors, because this information provides a good sense of the appetite for imported iron ore among Chinese mills and traders. China consumes about two-thirds of seaborne iron ore.

So China’s import appetite impacts iron ore players involved in the seaborne iron ore trade. These players include Cliffs Natural Resources (CLF), Vale SA (VALE), and Rio Tinto (RIO).

The iShares MSCI Global Metals & Mining Producers ETF (PICK) invests in iron ore, so this information affects it equally. BHP Billiton (BHP) is PICK’s top holding, making up 16.7% of the fund. The SPDR S&P Metals & Mining ETF (XME) also invests in some of these stocks.

Pullback in demand

The demand for steel in China usually weakens in September and October, since production typically abates ahead of the winter months. Along with increasing iron ore port inventories, lower demand could result in a fall in iron ore imports going forward.

In the next part of this series, we’ll see what’s supporting the current trend in iron ore imports in China and whether it’s sustainable in the long term.