Chevron’s Downstream Value Chains: Is It the Focus Area?

Chevron (CVX) is focusing on expanding its high-return sectors like Petrochemicals, Additives, and Lubricants.

Sept. 21 2016, Updated 8:04 a.m. ET

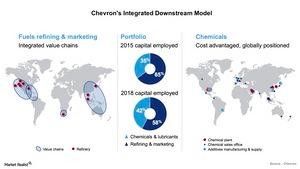

Chevron’s Downstream segment value chain

So far in this series, we have analyzed Chevron’s stock performance, segment-wise capex, analyst recommendations, and Upstream segment projects portfolio. In this part, we’ll look into Chevron’s Downstream segment portfolio and focus areas.

Chevron, along with its Refining and Marketing businesses, is focusing on its high-growth Petrochemicals operations. It is also focusing on the integration of refining and petrochemical complexes at various sites to increase its operational synergies and benefits.

Chevron (CVX) is focusing on expanding its high-return sectors like Petrochemicals, Additives, and Lubricants. By 2018, the company expects to increase the capital employed in its Chemicals and Lubricants segment to 42% from 35% in 2015.

Chevron plans to expand its petrochemical capacity and reach with some of its major ongoing projects. Chevron’s project on carboxylate addition is located in Singapore. Expected to be completed in 2017, this project is proposed to double its worldwide capacity of lubricants.

Chevron’s other petrochemical project, which includes the construction of ethylene and polyethylene facilities in Texas, is ~80% complete. The project is expected to commence by 2017.

In a bid to produce higher-value gasoline products and to improve efficiency, Chevron is spending on clean fuels and a co-generation project in Singapore that is expected to be operational by 2017. CVX is undertaking an expansion plan in its Richmond refinery to improve crude oil and refined product flexibility, which is expected to begin by 2018.

In brief, Chevron plans to optimize its Downstream integrated model to increase returns across the value chain.

For exposure to integrated energy sector stocks, you can consider the iShares Global Energy ETF (IXC). This ETF has ~56% exposure to the industry.