Bernstein Has Rated Johnson Controls ‘Outperform’

Johnson Controls (JCI) has a market cap of $42.3 billion. It rose 0.61% to close at $44.55 per share on September 16, 2016.

Sept. 19 2016, Published 1:15 p.m. ET

Price movement

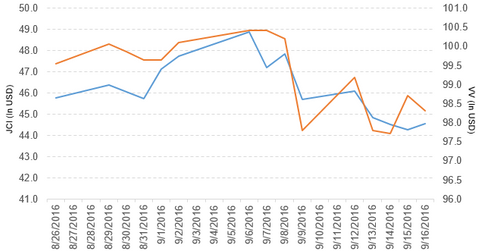

Johnson Controls (JCI) has a market cap of $42.3 billion. It rose 0.61% to close at $44.55 per share on September 16, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.5%, -8.0%, and 30.3%, respectively, on the same day.

JCI is trading 6.5% below its 20-day moving average, 7.3% below its 50-day moving average, and 7.0% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.15% of its holdings in Johnson Controls. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 6.1% on September 16.

The market caps of Johnson Controls’ competitors are as follows:

Johnson Controls’ rating

Bernstein has initiated coverage of Johnson Controls with an “outperform” rating and set the stock’s price target at $57 per share.

Performance of Johnson Controls in 3Q16

Johnson Controls reported 3Q16 net sales of $9.5 billion, a fall of 1.0% from $9.6 billion in 3Q15. Sales from its Building Efficiency and Power Solutions segments rose 33.0% and 3.1%, respectively. Sales from its Automotive Experience segment fell 19.3% between 3Q15 and 3Q16. The company’s gross profit margin rose 12.9%, and its income from continuing operations before income taxes fell 11.0%.

Its net income and EPS (earnings per share) rose to $383.0 million and $0.59, respectively, in 3Q16, compared to $178.0 million and $0.27 in 3Q15. JCI’s cash and cash equivalents fell 21.8%, and its inventories rose 25.0% from 4Q15 to 3Q16. Its current ratio and long-term debt-to-equity ratio fell to 0.92x and 0.54x, respectively, in 3Q16 compared to 1.0x and 0.55x in 4Q15.

Projections

Johnson Controls has made the following projections:

- EPS of $3.95–$3.98 for fiscal 2016, which reflects a strong operational performance

- EPS of $1.17–$1.20 for fiscal 4Q16

This guidance doesn’t include the impact of the Tyco merger and transaction, integration and separation costs, year-end pension and post-retirement mark-to-market adjustments, or other nonrecurring items.

Next, we’ll look at Dr Pepper Snapple Group (DPS).