Why Danaher Stock Rose after Its 4Q16 Results

Danaher Corporation (DHR) announced its 4Q16 and 2016 earnings results before the market opened on January 31, 2017. Let’s take a look.

Feb. 2 2017, Published 11:34 a.m. ET

Earnings announcement

Danaher Corporation (DHR) announced its 4Q16 and 2016 earnings results before the market opened on January 31, 2017.

In this series, we’ll analyze the company’s 4Q16 results, compare its results with analysts’ expectations, and analyze the factors that caused the deviation, if any. We’ll also take a look at management’s guidance, analysts’ expectations, and the outlook for the company in 2017.

Danaher stock reaction

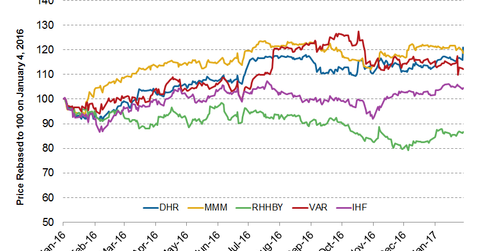

Danaher finished 2016 on a strong note, beating analysts’ earnings expectation in 4Q16. The company posted a strong operating performance in 4Q16. Moreover, Danaher’s adjusted EPS (earnings per share) came in at $1.05, compared to analysts’ consensus EPS estimate of $1.03.

DHR’s stock price rose ~4.4% during the intraday trading session on January 31, 2017. The company’s strong operational performance in 4Q16 and its higher adjusted EPS guidance for 2017 compared to 2016 helped it to close on a high note.

Peer performance

On the day of DHR’s earnings release, its peers 3M Company (MMM) and Varian Medical Systems (VAR) closed nearly flat. In contrast, industry major Roche Holding (RHHBY) closed nearly 1.6% above its previous day’s closing price.

The iShares Dow Jones US Health Care ETF (IHF), which tracks the performance of the US healthcare providers sector, closed at a rise of nearly 1% on January 31, 2017.

Next, we’ll look at Danaher’s segment-by-segment revenue for 4Q16.