What’s Driving the Record Spread Between HRC and CRC Prices?

US Spot hot rolled coil prices have risen in the ballpark of $200 per short ton in 2016. Spot cold rolled coil prices have risen by ~$300 per short ton.

Aug. 19 2016, Updated 11:04 a.m. ET

HRC-CRC spread

US Spot hot rolled coil (or HRC) prices have risen in the ballpark of $200 per short ton in 2016. In contrast, spot cold rolled coil (or CRC) prices have risen by ~$300 per short ton this year.

The surge in CRC prices has pushed the HRC-CRC spread to record highs this year. In this part of the series, we’ll explore what’s driving this record high HRC-CRC spread.

Note that ~20% of Nucor’s (NUE) sheet shipments are in the CRC category. For AK Steel (AKS), CRC formed 16.5% of its consolidated 2Q16 steel shipments. According to U.S. Steel Corporation (X), 33% of its flat rolled shipments in fiscal 2015 consisted of CRC products. ArcelorMittal (MT) also produces CRC products.

Key drivers

To be sure, the supply-demand equation for CRC is better than for HRC. Note that CRC and corrosion-resistant steel products are used in consumer products such as automobiles and appliances. Both these sectors have been strong thanks to US consumer appetite. On the supply side, the lead times for CRC products are higher than for HRC products.

Trade case

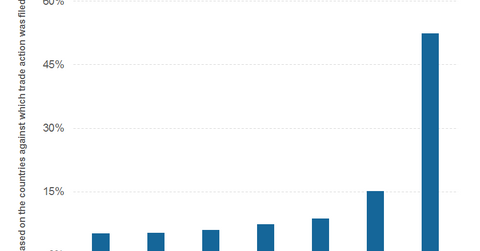

Another key driver of the $330 per short ton spike in spot CRC prices since December has been the hefty duty imposed on Chinese imports. China, which accounted for more than half of CRC imports in 2014, has been slapped with total duties in excess of 490%.

With half of the CRC import lines virtually switched off, prices got a natural boost. However, we could see CRC imports rising in the coming months. We’ll explore this more in the next part of the series.

Investors looking to diversify the risk of investing in a single security can also consider the SPDR S&P Global Natural Resources ETF (GNR). Almost one-quarter of GNR’s holdings are invested in steel and other metal companies.