What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

Dec. 4 2020, Updated 10:52 a.m. ET

JPMorgan Chase’s downgrades

In the last month, JPMorgan Chase (JPM) has seen three major downgrades. Analysts at Bernstein recently downgraded its rating to “market perform.” Bernstein previously had an “underperform” rating on the stock.

Citigroup (C) also downgraded JPMorgan from “buy” to “neutral” and has assigned a target price of $65. The analyst cited expensive valuations as the primary reason for the downgrade, mentioning that Bank of America seems to be better positioned to benefit from higher interest rates and has more upside potential given its cheap valuations.

In early August 2016, Deutsche Bank also stated that it preferred Bank of America to JPMorgan Chase. The consensus view still remains bullish on JPM, as 70% of analysts have rated it a “buy.”

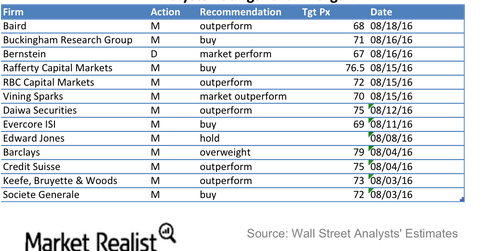

Wall Street ratings

Wall Street analysts have been bullish on shares of Wells Fargo in anticipation of an interest rate hike. In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

In comparison, JPMorgan Chase (JPM) has received a higher number of buy ratings—26 (70%) analysts have assigned “buy” ratings to JPM while nine (24%) have rated it as a “hold.” The stock currently has two (5%) “sell” ratings.

Target price and upside potential

Wells Fargo has a consensus target price of $53.14, resulting in a one-year upside potential of 9%. Comparatively, JPMorgan Chase has a consensus target price of $70.70 for the next 12-month period, implying a return potential of 9%.