Wells Fargo Downgrades BorgWarner to ‘Market Perform’

BorgWarner (BWA) fell 0.03% to close at $39.73 per share during the third week of December 2016.

Dec. 28 2016, Published 3:49 p.m. ET

Price movement

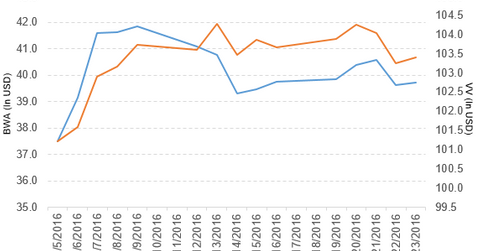

BorgWarner (BWA) fell 0.03% to close at $39.73 per share during the third week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -0.03%, 12.7%, and -6.6%, respectively, as of December 23.

BWA is trading 2.4% above its 20-day moving average, 9.1% above its 50-day moving average, and 14.8% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.03% of its holdings in BorgWarner. The YTD price movement of VV was 12.9% on December 23.

The market caps of BorgWarner’s competitors are as follows:

BWA’s rating

On December 21, 2016, BMO Capital initiated coverage of BorgWarner with an “outperform” rating and set the stock’s price target at $50 per share.

On December 19, 2016, Wells Fargo downgraded BorgWarner’s rating to “market perform” from “outperform” and maintained the stock’s price target at $42 per share.

Performance of BorgWarner in 3Q16

BorgWarner (BWA) reported 3Q16 net sales of $2.2 billion, a rise of 15.8% over its net sales of $1.9 billion in 3Q15. The company’s gross profit margin expanded 20 basis points, and its operating margin narrowed 580 basis points.

Its net income and EPS (earnings per share) fell to $83.3 million and $0.39, respectively, in 3Q16 compared to $157.4 million and $0.70, respectively, in 3Q15. The company reported non-GAAP (generally accepted accounting principles) EPS of $0.78 in 3Q16, a rise of 6.8% over 3Q15. BWA’s cash and inventories fell 10.2% and 5.0%, respectively, between 4Q15 and 3Q16.

Projections

BorgWarner (BWA) made the following projections for 4Q16:

- net sales growth of 14.3%–17.8%

- EPS of $0.82–$0.86, including ~$0.02 per share from its Remy acquisition

The company has made the following projections for 2016:

- net sales growth of 15.2%–16.0%

- EPS of $3.24–$3.28, including ~$0.12 per share from its Remy acquisition

Next, we’ll look at Hormel Foods (HRL).