Telsey Advisory Upgrades Deckers Outdoor to ‘Outperform’

Deckers Outdoor rose by 2.3% and closed at $68.55 per share on August 15. Its weekly, monthly, and YTD price movements were 7.6%, 10.2%, and 45.2%.

Aug. 16 2016, Published 1:51 p.m. ET

Price movement

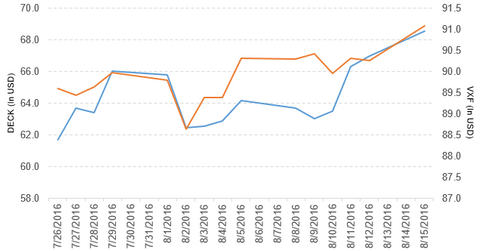

Deckers Outdoor (DECK) has a market cap of $2.2 billion. It rose by 2.3% and closed at $68.55 per share on August 15, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 7.6%, 10.2%, and 45.2%, respectively, on the same day.

Notably, DECK is now trading 8.1% above its 20-day moving average, 14.9% above its 50-day moving average, and 26.3% above its 200-day moving average.

Related ETF and peers

The Vanguard Extended Market ETF (VXF) invests 0.05% of its holdings in Deckers Outdoor and tracks a market-cap-weighted version of the S&P Total Market Index, excluding all S&P 500 stocks. The YTD price movement of VXF was 9.4% on August 15.

The market caps of Deckers Outdoor’s competitors are as follows:

Deckers Outdoor’s rating

Telsey Advisory Group has upgraded Deckers Outdoor rating to “outperform” from “market perform” and set the stock price target at $78.0 per share.

On August 12, 2016, Susquehanna has initiated the coverage of Deckers Outdoor rating to “neutral” and set the stock price target at $59 per share.

Performance in fiscal 1Q17

Deckers Outdoor reported fiscal 1Q17 net sales of $174.4 million, which is a fall of 18.4% from its net sales of $213.8 million in fiscal 1Q16. The company’s gross profit margin rose by 8.0% between fiscals 1Q16 and 1Q17.

Its net income and EPS (earnings per share) fell to -$58.9 million and -$1.84, respectively, in fiscal 1Q17, as compared to -$47.3 million and -$1.43, respectively, in fiscal 1Q16.

DECK’s cash and cash equivalents fell by 17.8%, and its inventories rose by 56.5% between fiscals 4Q16 and 1Q17. Its current ratio fell to 2.3x, and its debt-to-equity ratio rose to 0.48x in fiscal 1Q17, as compared to 3.3x and 0.32, respectively, in fiscal 4Q16.

Projections

The company has made the following projections for fiscal 2Q17:

- net sales growth in the range of -3% to flat

- gross margin in the range of 47.0%–47.5%

- EPS in the range of $4.05–$4.40 (excluding pretax charges) from restructuring charges of $10 million–$15 million

The company has made the following projections for fiscal 2017:

- net sales growth in the range of 1%–3%

- EPS in the range of ~$1.12–$1.22

Now we’ll look at Select Comfort.