How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

Aug. 24 2016, Published 11:50 a.m. ET

Overview

Europe represents a potential growth opportunity for Stryker (SYK), as the company currently has a low market share in Europe compared to other developed markets.

To gain a higher market share, Stryker established a TOM (Trans-Atlantic operating model) in early 2015 to restructure and reorganize its European operations.

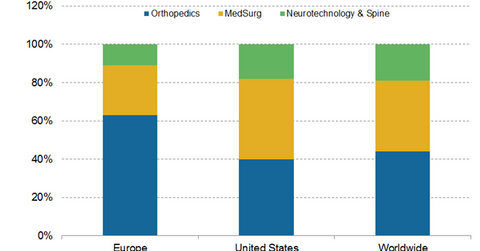

This move helped the company to deliver strong performances in Europe in both 2015 and 1H16. European sales witnessed higher-than-average growth last year following the implementation of TOM in 2015, as Stryker had been found to have a big opportunity in Europe, substantiated by its 2013 sales mix shown above.

Stryker expects to witness strength in its European sales beyond 2016 as it continues to expand in the high-growth European market. By leveraging its large, skilled sales force and its established brands, the company should soon capture a significant market share and establish itself as a key player in the European medical device market, gaining market share from its major competitors Smith & Nephew (SNN), Zimmer Biomet (ZBH), and Medtronic (MDT).

Investors seeking exposure to Stryker can invest in the First Trust Health Care AlphaDEX ETF (FXH). SYK accounts for ~1.6% of FXH’s total holdings.

Growth drivers

Stryker’s European sales were reported to be in the mid–single digits in 2Q16 after softness in sales was reported in 1Q16. Its European knee business delivered strong growth in 2Q16.

Due to the company’s TOM implementation, it has witnessed stronger sales owing to improved efficiencies, operational improvements, and a dedicated, efficient sales force in Europe. Stryker also plans to initiate international operations for its recently acquired Sage Products after having achieved success in Canada.

Stryker’s endoscopy, instruments, and knee divisions are underrepresented markets in Europe, which the company aims to expand in the near future.