Risk and International Assets in a Portfolio

Although international investing does tend to mitigate risk and diversify portfolios, there are certain risks involved.

Sept. 1 2020, Updated 11:17 a.m. ET

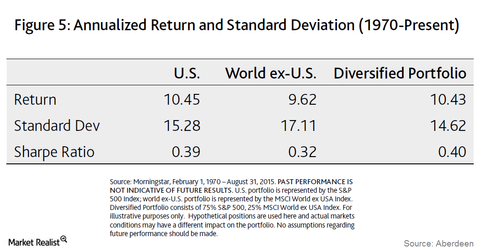

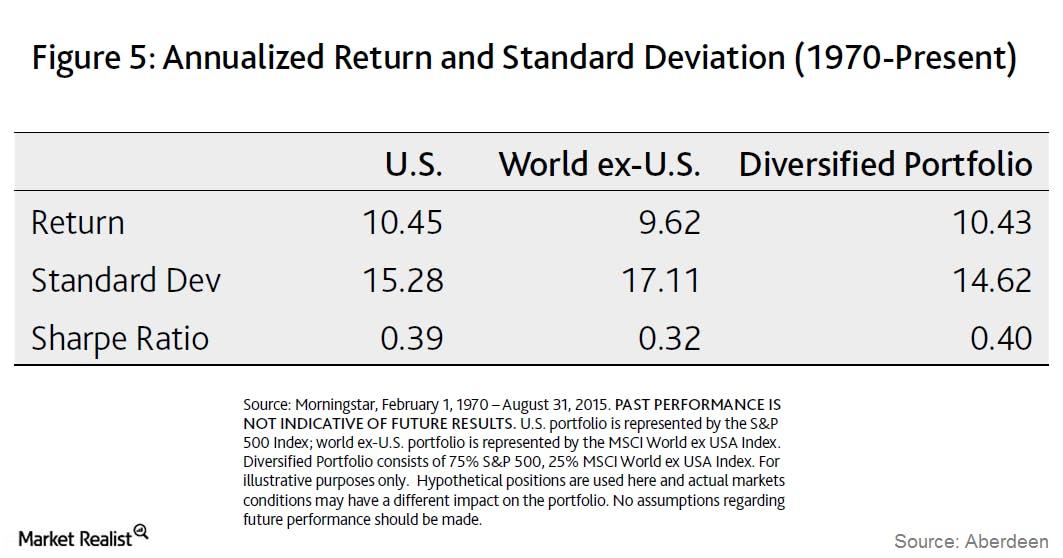

To illustrate how an international allocation can help diversify a portfolio invested entirely in domestic assets, we will look at how returns and risk are affected by an allocation to international equities. Figure 5 below compares the annualized historical performance of three portfolios: one that invested 100% in U.S. equity, one invested 100 % in non-U.S. equity and one invested 75% in U.S. equities and 25% in global equities.

You can see below each portfolio’s historical annualized return, as well as its volatility or risk (as measured by standard deviation) and its Sharpe ratio, which tells the level of return that can be expected for a given level of risk. The optimal portfolio would have the highest Sharpe ratio, or in other words, the highest risk-adjusted return

When comparing the three portfolios, we find that the diversified portfolio has lower portfolio risk (as measured by standard deviation) relative to both the U.S. equity portfolio and the non-U.S. equity portfolio. At the same time, returns for the diversified portfolio are nearly equal to the U.S. equity portfolio and somewhat higher than for the global equity portfolio.

The diversified portfolio has lower risk than both of the other portfolios, resulting in the highest Sharpe ratio of the three portfolios. Therefore, international diversification can help investors meet their objective of obtaining the greatest amount of returns for their individual risk tolerance. International diversification can also reduce risk by significantly increasing the universe of investable stocks from which an investor can choose. This can help minimize the impact that any one stock can have on the overall portfolio. The top 10 holdings of the S&P 500 Index account for about 17% of the index’s total market capitalization; therefore, a shock to any of these holdings can have a significant impact on overall performance of the index. In comparison, within the MSCI All Country World Index (ACWI), this weighting would be around 2.5%.

Market Realist – The risks of international investing

Although international investing does tend to mitigate risk and diversify portfolios, there are still certain risks involved. Investors should remain cautious of the following risks when investing in international equities:

- The biggest risk investors face when investing internationally is currency risk or exchange rate risk. A strengthening dollar (UUP) could mean a reduction in value of international assets (FAM) held by US investors. Also, foreign equities tend to attract higher fees and expenses. So investors should be cautious of the extraneous costs involved.

- Political and economic instability could pose a danger to investments in foreign equities. Geopolitical tensions in Turkey or the recent instability in Europe (FEZ) (EZU) after the United Kingdom’s (EWU) Brexit vote are good examples.

- As we saw in the first part of the series, corporate governance practices aren’t the same all over the world. Financial disclosure practices and governance standards could be inferior to those of the United States. For example, there’s a lack of transparency in Japan (JEQ). Although its corporate governance standards have recently been revised, they are still woefully inadequate compared to the United States (SPY). So for investors looking to invest in robust companies with good fundamentals, the lack of financial information may prove to be a hindrance.

- International stocks tend to be more volatile than domestic stocks. To get the full benefit of international diversification, investors should be prepared to hold international assets over the long term. This is especially true in the current environment in which US equities (VTI) have consistently outperformed emerging markets (FEO) and global equities (ACWI) for the past three years.