Why Did Foot Locker’s Price Target Rise?

Foot Locker has a market cap of $9.3 billion. It fell by 0.35% and closed at $68.25 per share on August 22, 2016. It reported fiscal 2Q16 sales of $1.8 billion.

Aug. 23 2016, Updated 3:04 p.m. ET

Price movement

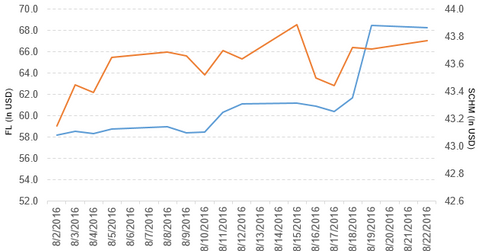

Foot Locker (FL) has a market cap of $9.3 billion. It fell by 0.35% and closed at $68.25 per share on August 22, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 11.6%, 15.3%, and 6.3%, respectively, on the same day. Foot Locker is trading 13.7% above its 20-day moving average, 19.1% above its 50-day moving average, and 11.6% above its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.33% of its holdings in Foot Locker. SCHM tracks a market-cap-weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index. SCHM’s YTD price movement was 10.0% on August 22.

The iShares Morningstar Mid Core ETF (JKG) invests 0.49% of its holdings in Foot Locker. JKG tracks a market-cap-weighted index of US mid-cap firms that exhibit both growth and value characteristics as determined by multifactor selection.

The market caps of Foot Locker’s peers are as follows:

Foot Locker’s rating

Jefferies raised Foot Locker’s target price to $80 from $73 per share. It maintained the stock rating as a “buy.” Canaccord Genuity increased Foot Locker’s target price to $79 from $75 per share. It rated the stock as a “buy.”

UBS increased Foot Locker’s target price to $76 from $69 per share. It maintained the stock rating as a “buy.” Susquehanna raised Foot Locker’s target price to $80 from $73 per share. It rated the stock as “positive.”

TheStreet Ratings rated the stock as a “buy” with a score of “B.”

This rise in the target price came after the company’s strong fiscal 2Q16 results.

Performance in fiscal 2Q16

Foot Locker reported fiscal 2Q16 sales of $1.8 billion—a rise of 5.9% compared to sales of $1.7 billion in fiscal 2Q15. The company’s cost of sales as a percentage of sales rose by 3.0% in fiscal 2Q16—compared to the same period last year.

Its net income and EPS (earnings per share) rose to $127.0 million and $0.94, respectively, in fiscal 2Q16—compared to $119.0 million and $0.84, respectively, in fiscal 2Q15.

Foot Locker’s cash and cash equivalents fell by 2.6% and its merchandise inventories rose by 1.7% in fiscal 2Q16—compared to the same period last year. Its current ratio and debt-to-equity ratio rose to 3.8x and 0.46x, respectively, in fiscal 2Q16—compared to 3.4x and 0.44x, respectively, in fiscal 2Q15.

The company noted that “During the second quarter, the company opened 23 new stores, remodeled or relocated 64 stores, and closed 18 stores.”

Quarterly dividend

Foot Locker declared a quarterly cash dividend of $0.28 per share on its common stock. The dividend will be paid on October 28, 2016, to shareholders of record on October 14, 2016.

In the next part, we’ll discuss General Motors (GM).