Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.

Nov. 20 2020, Updated 12:19 p.m. ET

Our outlook on fixed income improves

We have turned more positive on some fixed income assets due to elevated geopolitical risks and easy monetary policy in a low-growth world. We especially like income, including investment-grade credit. We see investment-grade corporate debt as attractive in a world hungry for yield. We also prefer emerging market (EM) debt, whose relatively higher yields now look more attractive post Brexit given that some key headwinds to EMs have turned into tailwinds.

We’re neutral toward U.S. Treasuries and European sovereigns, but we do like the former as a hedge against global risks. We also prefer selected eurozone peripheral sovereigns.

Market Realist – US investment-grade bonds offer higher yield

Under the current uncertain economic circumstances, investors searching for higher yields might turn to fixed income. US investment-grade bonds (LQD) offer higher yields (HYG) coupled with more safety compared to other countries’ bonds.

This is clear from Bank of America (BAC) data that showed that investment-grade corporate debt comprises 12% of the global bond market but makes up around 32% of yield income.

In the past, stimulus measures introduced by the Federal Reserve were mainly responsible for driving the US corporate debt (SHYG) market. Current performance is driven more by negative interest rates in prominent economies such as Japan and the European Union.

Emerging market debt

Emerging market debt (EMB) also looks good due to rising credit quality. This comes on the back of an improving economy and higher yields relative to developed markets’ corporate and Treasury bonds. While most developed countries remained laggards, developing countries such as Brazil and South Africa have posted higher returns in recent months.

Data from Barclays indexes show that Brazil’s US dollar denominated debt has gained around 21% year-to-date, and yields have fallen to the lowest level since 2015. Similarly, Venezuelan bonds have advanced handsomely with a year-to-date total return of 31.5% in dollar terms for bonds maturing in 2019.

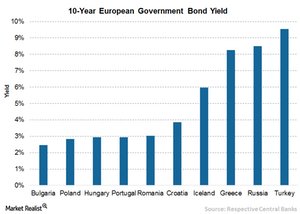

Peripheral European markets

For investors seeking higher fixed income returns, peripheral European (IEV) markets could be a better option due to their attractive bond yields. Turkey offers the highest yield in the region on a ten-year government bond at 9.5%. It’s followed by Greece at 8.3%, Iceland at 6.0%, Croatia at 3.9%, Romania at 3.0%, Portugal at 2.9%, and Hungary at 2.9%.